Pre-Foreclosure Help in Searcy, Arkansas

You Know This Place. You Know These Streets.

If you’ve called Searcy home for any length of time, you know what makes this city different. You’ve driven Race Street and Beebe-Capps Expressway countless times—past Harding University where the campus bells mark the hours, through downtown where the courthouse stands watch over the square, out to the shopping centers and restaurants that have grown up along the highway. You’ve probably spent summer evenings at Riverside Park watching the Little Red River flow by, or taken your kids to Berryhill Park, or walked through the historic neighborhoods where oak trees shade the streets.

You know the rhythm of this town. How it’s big enough to have what you need—good schools, a regional medical center, plenty of shopping and restaurants—but small enough that you still see familiar faces at Walmart or church on Sunday. You know the neighborhoods—maybe you’re in one of the historic areas near downtown with homes that have been there for generations, or in one of the subdivisions that went up in the 1980s and ’90s, or out toward Highway 367 where newer development has spread.

This is the kind of place where Harding University shapes the culture and economy, where “Are you Church of Christ?” is a common question, where Friday nights in the fall mean Searcy Lions football. Where your home isn’t just an address on West Arch or South Main—it’s part of a community that values faith, family, education, and the slower pace of life that makes small-town Arkansas worth living in.

So when you’re facing pre-foreclosure here in White County, it doesn’t feel like just a financial problem. It feels deeply personal. It feels like you’re failing in a town that knows your name, where your struggles won’t stay private for long.

What Pre-Foreclosure Feels Like in a Town Where Everyone Knows Your Business

There’s a particular weight to facing foreclosure in a place like Searcy. This isn’t an anonymous big city where you can blend into the crowd. If you’ve lived here any length of time, you have connections—through church, through Harding, through your kids’ schools, through work. People know you, or they know someone who knows you.

Maybe you work at Harding—in administration, maintenance, the cafeteria, or you’re faculty—and your employment is stable but the pay is modest. Maybe you work at White County Medical Center or one of the manufacturing plants like Hytrol Conveyor Company. Maybe you’re at one of the chicken processing facilities or drive into Little Rock for work, and the hour-long commute is eating up your budget with gas prices what they are.

Maybe you bought your house during better times, thinking Searcy’s stability would mean your own stability. Small-town Arkansas was supposed to be affordable. But property taxes, insurance, utilities, groceries—everything’s gone up while your income has stayed flat. A medical bill, an unexpected car repair, helping out family members who were struggling—suddenly you’re behind, and catching up feels impossible.

You worry about who’s going to find out. You avoid certain people at church because you’re afraid they’ll ask questions. You wonder if your kids’ friends’ parents have heard anything. In a town this size, secrets don’t stay secret for long.

And here’s something important to understand: You’re not out of time yet. Pre-foreclosure means you still have options. It means the bank hasn’t taken your home. It means you can still take a breath, think clearly, and make a decision that works for you and your family.

How Foreclosure Actually Works in Arkansas

Let’s talk about what’s really happening, because understanding the process takes away some of the fear and uncertainty. In Arkansas, most foreclosures are what’s called “non-judicial,” which means the bank doesn’t have to go to court to foreclose on your home. This is different from some states where a judge has to approve everything.

Here’s the typical timeline:

The Arkansas Foreclosure Timeline

When You First Miss a Payment: Nothing happens immediately. The lender sends notices. You get phone calls. But they’re not rushing to foreclose—they’d actually prefer to work something out with you because foreclosure costs them money and time too.

After 30-90 Days: The letters get more serious. You start seeing terms like “default notice” or “acceleration clause.” This is where many people start to panic and avoid opening their mail. But you still have time to act.

The Notice of Default and Intent to Sell: Under Arkansas law, your lender must send you written notice before it can sell your home. This notice must give you at least 30 days and must include:

- The total amount you owe

- The deadline to bring your account current

- A clear statement that if you don’t pay by that date, they intend to sell your property

This notice usually comes by certified mail to your last known address. Whether you’re in one of the older homes near downtown, in a neighborhood off Highway 367, or in a subdivision near the university, you’ll receive it. This is your official warning that things are getting serious.

The Publication Requirement: Here in White County, the lender also has to publish a notice of the foreclosure sale in a local newspaper once a week for two consecutive weeks. The first publication must happen at least 20 days before the scheduled sale date. This is public notice—anyone can see it, and in a town like Searcy where people still read the Daily Citizen, that means your situation becomes more public than you’d like.

The Foreclosure Sale: If you haven’t been able to work something out or sell the property yourself, your home goes to auction. In Arkansas, this typically happens at the county courthouse. For White County, that’s at the historic courthouse right on the square in downtown Searcy.

The sale is public, usually held on a weekday morning. Your home is sold to the highest bidder—sometimes the bank itself buys it back, sometimes it’s an investor looking for properties.

After the Sale: Once your home is sold at auction, you typically have to move out quickly. Arkansas doesn’t have a long redemption period as some states do. What’s done is done, and it happens fast.

Here’s What Most People Don’t Realize

The non-judicial process can move faster than you think. But here’s the crucial part: at any point before that auction gavel comes down, you still have options. You can sell the house yourself. You can try to negotiate with the bank. You can explore a short sale if you owe more than the home is worth.

The key is not waiting until the last minute. Not because we’re trying to pressure you—we’re not—but because the earlier you take action, the more choices you have and the better your outcome can be.

Why Searcy Homes Are Different

Your home here isn’t like a generic house in just any Arkansas town. Searcy has a character all its own—a blend of small-town values, university culture, and that distinctly Central Arkansas feel that’s comfortable, familiar, and deeply rooted.

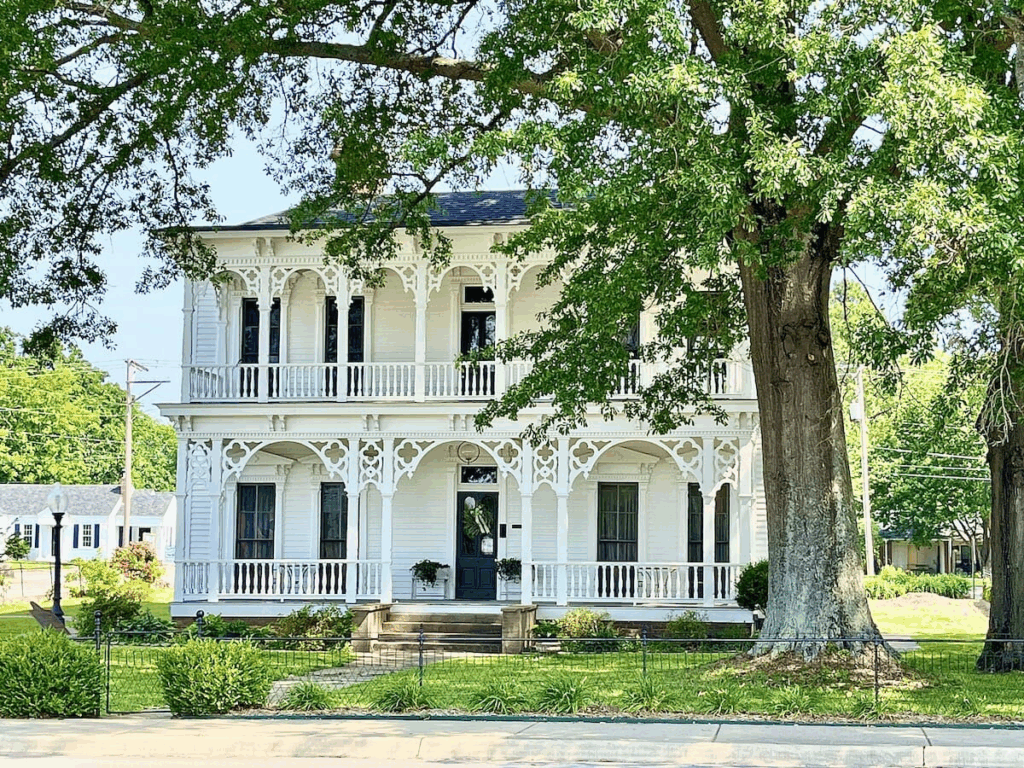

If you’re in one of the historic neighborhoods near downtown—the areas around the courthouse, along Center Street, near the old high school—your home might be a Craftsman or Victorian with character and history that newer houses can’t replicate. If you’re in one of the neighborhoods that went up in the 1970s and ’80s—around Gin Creek, near the junior high, off Highway 367—you might have a traditional ranch or split-level that’s been perfect for raising a family. If you’re in one of the newer subdivisions toward Bald Knob or Cabot, you might have a more modern home in a quieter, more rural setting.

Maybe you’ve got a place with a big yard where your kids have played for years, where you’ve hosted family gatherings and church groups. Maybe it’s a modest home you’ve slowly improved over time, one project at a time. Maybe it’s the house you bought when you got that job at Harding or the hospital, thinking you’d finally found stability in a town known for being steady and dependable.

These aren’t just addresses on a White County property record. They’re places with memories—birthday parties, Easter egg hunts, teaching your kids to ride bikes in the driveway, sitting on the porch watching thunderstorms roll in from the west, Sunday afternoons grilling out with family.

And here’s the truth: properties in Searcy have real value, even if you’re behind on payments, even if the house needs some work. You’re in the largest city in White County, a regional hub for healthcare, education, and commerce. You’re home to Harding University with its 4,500 students providing economic stability. You’re just an hour from Little Rock but with a cost of living that’s significantly lower. You’re in a town that’s been voted one of the best small towns in Arkansas, with good schools, low crime, and a strong sense of community.

That means your home, even in pre-foreclosure, has value to someone. And that value might be your way out of this situation.

The Weight You’re Carrying Right Now

Let’s just be honest about what you’re going through: this is heavy. You’re probably not sleeping well. Every time the phone rings and you don’t recognize the number, your stomach drops. You avoid checking the mail because you’re scared of what might be waiting in the mailbox. You’ve run the numbers a hundred times, trying to figure out how to make it work, but the math just doesn’t add up.

Maybe you’ve thought about asking family for help, but you don’t want to burden them or admit you’re struggling. Maybe you’re embarrassed because in a town like Searcy where faith and community are so important, financial struggle can feel like a moral failing even though it’s not. If you’re married, this might be causing tension in your relationship—money stress always does. If you’re on your own, the isolation might be crushing because you feel like you have no one to talk to about it.

Maybe you see people at church or around town who seem to have it all together, and you wonder what’s wrong with you that you can’t keep up. Maybe you drive past the nicer neighborhoods and feel like a failure. Maybe you’re a Harding employee or alumnus, and there’s an extra layer of shame because you feel like you should be doing better.

You might be praying about it constantly, laying it down at the altar, asking God why this is happening—and some days that brings peace, and some days the fear overwhelms the faith.

Here’s what we want you to know: This situation doesn’t define who you are. You’re not a failure. You’re not irresponsible. You’re not less-than. You’re a person facing an incredibly difficult situation, and you’re trying to figure out the best path forward.

The fact that you’re reading this right now means you’re actively looking for solutions. That takes courage. Many people in your situation simply shut down, ignore the problem, and hope it goes away. You’re not doing that. You’re here, you’re reading, you’re thinking. That matters.

Your Options

There’s no urgency here. No one’s going to push you into anything. We just want you to understand what’s actually possible, because sometimes knowing you have choices makes it easier to breathe and think clearly.

Option 1: Catch Up on Payments

If you’ve come into some money—maybe an inheritance, a bonus at work, help from family—you can pay what you owe and get your account current. This stops the foreclosure process immediately. If this is realistic for you, great. Problem solved.

But if you’re reading this page, it’s probably because that’s not an option right now. And that’s okay. There are other paths forward.

Option 2: Loan Modification or Forbearance

You can try working directly with your lender to modify your loan. Sometimes they’ll lower your payment, extend the term, defer some of what you owe, or in rare cases even reduce the principal. Sometimes they’ll agree to forbearance, which means you pause or reduce payments temporarily while you get back on your feet.

This can work, but it’s slow. There’s extensive paperwork. Lots of phone calls. Long wait times. And there’s no guarantee they’ll approve it—they’re under no obligation to help.

If you want to try this route, we support that. But understand it takes time, and time might be something you’re running short on.

Option 3: Sell Your Home Yourself

If you have equity in your home—meaning it’s worth more than you owe—you could list it with a real estate agent and try to sell it the traditional way. You’d pay off the mortgage, cover the closing costs and agent commissions (usually 5-6%), and keep whatever’s left over.

The challenge? Traditional sales take time. Even in Searcy’s steady market, it could take weeks or months to find a buyer, especially if your home needs repairs or updates, or if it’s in a less desirable location. And if you’re already in pre-foreclosure, you might not have that kind of time. Plus, getting your house “show ready” can feel overwhelming when you’re already stressed about money.

Option 4: Short Sale

If you owe more on your house than it’s worth—which can happen if you bought during a market peak or took out too much equity—a short sale might be possible. This is where the bank agrees to let you sell the home for less than the mortgage balance. They take a loss, but it’s better for them than going through foreclosure.

Short sales can help you avoid foreclosure on your credit report, but they’re complicated and slow. The bank has to approve every step, which can take months. And you still have to find a buyer willing to wait through the entire approval process. Many buyers won’t.

Option 5: Sell Directly to a Cash Buyer

This is where we come in, and it’s the option that brings the most relief to people in your situation.

Here’s how it works: We buy houses directly, in any condition, in any situation. You don’t have to fix anything. You don’t have to clean anything. You don’t have to stage it or wait months for the right buyer or deal with bank approval processes.

We look at your home, we look at your situation, and we make you a fair cash offer. If you accept it, we handle all the details—the paperwork, the title work, the closing, everything. You can close in as little as a week or two if you need to move fast, or we can work on your timeline if you need a little more time to make arrangements.

No real estate agent commissions eating into your proceeds. No closing costs coming out of your pocket. No judgment about your situation or why you’re selling.

You walk away without the weight of the mortgage hanging over you, without the foreclosure on your record, and you can start the next chapter of your life with a clean slate.

Why People in Searcy Choose This Route

We’ve worked with families all over White County—people with homes near Harding, people in the historic neighborhoods downtown, people in subdivisions off Highway 367, people out toward Bald Knob and Kensett. Here’s what they tell us:

“We just needed it to be over.” The constant stress of waiting, wondering, dealing with the lender—it was exhausting. Selling quickly gave them immediate peace of mind.

“We didn’t have the money to fix it up.” Many homes in pre-foreclosure need repairs. Selling to us meant they didn’t have to come up with thousands of dollars they didn’t have to replace that old roof, fix the HVAC, or update the kitchen.

“We didn’t want it to become public.” A foreclosure sale at the courthouse on the square is a matter of public record, and in a town like Searcy where everyone seems to know everyone, privacy is precious. The foreclosure notice gets published in the Daily Citizen. People talk. Selling privately is quiet, dignified, and nobody has to know your business.

“We needed to move on with our lives.” Whether they were relocating for a job, dealing with a divorce, moving to be closer to aging parents, or just needed a fresh start somewhere else, a quick sale let them close that chapter and move forward.

“The commute to Little Rock was killing us.” Gas prices, vehicle maintenance, time away from family—sometimes the daily drive stops making financial sense, and moving closer to work became the right choice.

“We inherited the house from our parents.” This is incredibly common in Searcy where families have deep roots. Adult children inherit their parents’ or grandparents’ home but already own their own house, and they can’t afford to keep up two properties or become landlords.

“Medical bills wiped us out.” Even with insurance, a serious illness or injury can create debt that makes the mortgage impossible to maintain. Selling let them start over without that burden.

What Makes Searcy Special

Let’s talk about this city for a minute, because it deserves recognition.

Searcy was founded in 1837 and named after Richard Searcy, a judge and legislator. It became the White County seat in 1838, and that courthouse you see on the square today—the beautiful red brick building—has been there since 1871, watching over the town for over 150 years. The town grew slowly but steadily, through the Civil War, through Reconstruction, through the agricultural boom of the early 1900s.

Then in 1924, Harding College (now Harding University) moved to Searcy from Morrilton. That decision shaped the city’s identity forever. Harding brought stability, education, culture, and a strong Christian presence that still defines the community today. The university now has over 4,500 students and provides jobs for hundreds of residents. It’s consistently ranked as one of the best Christian universities in the country.

Today, Searcy is known for several things:

- Being home to Harding University and the strong Church of Christ presence that comes with it

- White County Medical Center, a regional healthcare hub serving the entire county

- Manufacturing companies like Hytrol Conveyor provide good-paying jobs

- Being a retail and commerce hub for eastern White County and parts of the surrounding counties

- Having excellent public schools—Searcy School District serves over 4,000 students

- The Little Red River runs through town, providing recreation and natural beauty

- A low cost of living compared to Little Rock, with homes that are actually affordable

- That small-town feel where people still know their neighbors and care about the community

This is a town that values faith, family, and education. Where Friday night football games bring the community together. Where the courthouse square is still the heart of downtown. Where you can raise a family in safety and security. Where your kids can walk to school without you worrying. Where life moves at a pace that lets you actually live instead of just survive.

If your home is part of this place—whether it’s in one of the historic neighborhoods near downtown, or in a family subdivision near the schools, or out toward the countryside, or anywhere in this solid, dependable community—it has value. Real value to someone who’s looking for what Searcy offers.

And that includes us.

No Pressure. No Games. Just Honest Help.

We’re not here to pressure you into anything. We’re not going to tell you that you have to decide today, or that this is your only chance, or any of the high-pressure tactics you might have experienced from other companies. That’s not how we work, and it’s not how we’d want to be treated if we were in your shoes.

What we are here to do is give you an option that might bring some relief. If you want to talk, we’ll listen without judgment. If you want to ask questions, we’ll answer them honestly and completely. If you need time to think about it and talk it over with family, take all the time you need.

This is your home. Your decision. Your life. We’re just here to help if that’s what you want.

What Happens If You Reach Out

If you decide to call or fill out the form on this page, here’s exactly what happens next:

- We’ll have a conversation. No pressure, no sales pitch. Just an honest talk about your situation, your home, what you owe, and what you’re hoping to accomplish.

- We’ll come look at your property. If you’re comfortable with it, we’ll schedule a time to come by and see the house. We’ll ask some questions about the condition, the neighborhood, your timeline, and what’s important to you.

- We’ll make you a fair cash offer. Usually within 24-48 hours, we’ll come back with an offer in writing. No obligation whatsoever. If it works for you, wonderful. If it doesn’t, that’s completely okay too.

- You take whatever time you need to decide. Think about it. Pray about it. Talk it over with your spouse, your kids, your parents, your trusted friends, your church family. Sleep on it. We’ll be here when you’re ready.

- If you accept, we take care of everything. We work with a local title company, we handle all the paperwork and legal details, and we make the process as smooth and stress-free as possible. You don’t have to worry about a single thing.

This Isn’t the End of Your Story

Whatever happens with this house, it’s not the end of your story. You’re going to be okay. Maybe that’s hard to believe right now, but it’s true.

Losing a home is painful. It’s one of the hardest things a person can go through, especially in a place like Searcy where home and community and church are so interconnected. But it’s not the total of who you are or what you’re capable of building in the future.

People come back from this. People rebuild their lives and their credit. People find new places to call home, new rhythms, new peace. You will too. You’re stronger than you think, and you have more resources—internal and external—than you probably realize right now.

Right now, you just need to take the next step. And if that next step is reaching out to us to explore your options, we’ll be here to walk through it with you.

Frequently Asked Questions

What is pre-foreclosure and how does it work?

Pre-foreclosure is that window of time between when you fall behind on your mortgage and when your home is actually sold at auction. It’s the warning phase—the bank has started the foreclosure process, but your home still legally belongs to you. Here in Arkansas, this typically starts after you’ve missed several payments and your lender sends a Notice of Default and Intent to Sell. During pre-foreclosure, you still live in your home, you still own it, and most importantly, you still have the power to decide what happens next. In White County, you’ll see the notice published in the Searcy Daily Citizen, and by law you have at least 30 days from that official notice before any sale can take place. This window is your opportunity—you can catch up on payments if possible, work out a deal with your lender, or sell the property on your own terms before the bank takes control. Pre-foreclosure feels terrifying because the language in the letters is intimidating and official, but it’s actually the period when you still have the most options and the most control over the outcome.

Can I sell my house during pre-foreclosure?

Absolutely, yes. And honestly, selling during pre-foreclosure is often the smartest decision you can make. It’s completely legal and actually quite common. Your home is still yours until that auction actually happens, which means you have every right to sell it just like any other time—the only difference is you need to move faster than a traditional sale typically allows. Here in Searcy, if you listed your home near Harding or in one of the neighborhoods off Race Street with a regular real estate agent, you’d probably wait several weeks or months for the right buyer, and your house would need to be in good showing condition. But when you’re in pre-foreclosure, you don’t have months to wait, and you probably don’t have the money or emotional energy to do repairs, stage the house, and keep it spotless for showings. That’s exactly why selling directly to a cash buyer makes sense for so many people in your situation. We can close in as little as 7-10 days if needed, which gives you plenty of time to pay off the mortgage before the foreclosure sale happens. You walk away without the foreclosure hitting your credit report, and you’re not scrambling in panic at the last possible moment. Plenty of homeowners throughout White County have sold during pre-foreclosure and moved forward with their dignity and credit intact.

How long do I have before my house goes to foreclosure?

The honest answer is: it depends on exactly where you are in the process, but Arkansas doesn’t give you as much time as some other states do. Once your lender sends that official Notice of Default and Intent to Sell, you’re looking at a minimum of 30 days before they can schedule the auction. But here’s what people don’t always realize—by the time you receive that notice, you’ve usually already been behind for several months. Most lenders don’t start foreclosure proceedings until you’re 90-120 days delinquent. So from your very first missed payment to the actual foreclosure auction, you might have four to six months total. But the second half of that timeline moves very fast. Once the notice goes out and gets published in the Daily Citizen, the clock is really ticking, and in a town like Searcy where people still read the local paper, that notice becomes more public than you’d like. If you’re reading this and you’ve already received that official notice, don’t waste another week hoping things will magically work themselves out. You probably have a few weeks, maybe a month or two at most. That’s enough time to sell your home if you act now, but it’s not enough time to procrastinate or keep waiting for the perfect solution to appear. Every day you wait is a day closer to losing your options entirely. If you’re earlier in the process—maybe you’ve just received your first default letter—you have more breathing room, but you should still treat it seriously and start exploring your options right now while you still have time to make good decisions.

Will selling my house in pre-foreclosure stop foreclosure?

Yes, it absolutely will—if you sell in time and for enough to cover what you owe on the mortgage. When you sell your home and the mortgage gets paid off completely, the foreclosure process stops immediately because there’s nothing left to foreclose on. The debt is satisfied, the bank gets their money, you get whatever’s left over, and you’re done. Your credit will show the late payments you already made, but you avoid the actual foreclosure, which is far more damaging and stays on your credit report for seven years. Even if your home is worth less than what you owe—which happens more often than people think, especially in smaller markets like Searcy—selling can still stop foreclosure if your lender agrees to a short sale, where they accept less than the full mortgage balance. We’ve helped homeowners in Searcy and throughout White County do exactly this—we negotiate with their bank so they can sell, pay off what they can, and walk away without the foreclosure hanging over their head like a dark cloud. The key is acting while you still have time on your side. Once that auction date is set and you’re down to the final few days, it becomes much harder and sometimes impossible to pull off. But if you reach out early enough in the process, selling your home is absolutely an effective way to stop foreclosure in its tracks and move forward with a much cleaner financial slate.

What happens if I do nothing during pre-foreclosure?

If you do nothing, the process moves forward on its own timeline, and it doesn’t end well for you. Your lender will continue with the foreclosure proceedings, your home will be sold at public auction on the steps of the White County courthouse right on the square in downtown Searcy, and you’ll lose the house. Depending on what the property sells for at auction and how much you owed, you might still owe money after it’s gone—Arkansas allows what are called deficiency judgments, which means if your house sells for less than your remaining mortgage balance, the bank can sue you for the difference. So you lose your home and potentially still owe thousands of dollars. The foreclosure goes on your credit report and destroys your credit score, making it incredibly difficult to rent a decent place, get approved for a car loan, or qualify for another mortgage for at least seven years. If you’re still living in the house up until the sale, you’ll eventually be forced to leave, and if you don’t leave voluntarily, the new owner can start eviction proceedings against you. Beyond the financial and legal consequences, there’s the emotional and social toll. A foreclosure sale is public record—it’s published in the newspaper, it happens at the courthouse where anyone can watch, and in a town like Searcy where everyone seems to know everyone or at least know someone who knows you, it’s hard to keep private. On a personal level, doing nothing usually comes from feeling completely paralyzed—overwhelmed, ashamed, not knowing where to turn for help—but that paralysis only makes the outcome worse. The hardest part is taking that first step and making that first phone call, but once you do, you’ll find there are more options available than you realized. Doing nothing guarantees the worst possible outcome. Doing something—even if it’s just reaching out to have a conversation—opens up real possibilities for a better ending to this chapter.

Will selling to you hurt my credit less than a foreclosure?

Yes, significantly. A foreclosure stays on your credit report for seven years and causes massive damage to your credit score—often dropping it by 200-300 points or more. Selling your home, even when you’re behind on payments, shows that you took responsibility and resolved the debt. You’ll still have a record of the late payments you made, which does affect your score, but it’s nowhere near as devastating as an actual foreclosure. Many lenders view someone who sold their home to avoid foreclosure much more favorably than someone who let it go all the way to auction. It shows character and responsibility even in difficult circumstances.

What if I owe more than the house is worth?

We can still help. Sometimes we can work directly with your lender to negotiate what’s called a short sale, where they agree to accept less than the full payoff amount. We’ve done this many times and understand how to navigate the process. It takes some time and paperwork, but it’s absolutely possible, and it’s still much better for your credit than a foreclosure.

Do I have to pay any fees or commissions?

No. We don’t charge any fees, and there are no real estate agent commissions. We make you an offer, and if you accept it, that’s the amount you receive. We handle all the closing costs on our end. What we offer is what you get.

How quickly can we close?

As fast as you need us to. We can close in as little as 7-10 days if time is critical and you’re up against a foreclosure deadline. Or we can wait a few weeks if you need more time to figure out your next living situation and make moving arrangements. We work on your timeline.

What if my house needs a lot of work?

Doesn’t matter to us at all. We buy houses in any condition. We’ve bought homes that needed new roofs, new HVAC systems, foundation repairs, complete renovations—you name it, we’ve seen it and bought it. You don’t have to fix a single thing or spend a single dollar on repairs.

Can I stay in the house for a little while after we close?

In many cases, yes. If you need a few extra days or even a couple of weeks after closing to move out and get settled somewhere else, we can often work that into the agreement. Just let us know what you need, and we’ll do our best to accommodate your situation.

What parts of White County do you cover?

All of it. Whether you’re in Searcy proper, out in Bald Knob, Kensett, Beebe, Judsonia, McRae, or anywhere else in White County, we’re interested in helping. We work throughout the entire area.

Take a Breath. You’ve Got This.

You’ve made it all the way through this page, which means you’re seriously thinking about your options and looking for a way forward. That’s good. That’s really, really good.

Whatever you decide to do, please know that you’re not alone in this. Thousands of people have been exactly where you are right now, facing the same fear and uncertainty, and they found a way through. You will too.

If you want to talk with someone who will listen without judgment and help you understand your options, we’re here. No pressure. No sales tactics. Just an honest conversation about what might be possible for you.

Titan Property Investors

Your trusted partner in real estate

Address

731 S. 7th St.

Heber Springs, AR 72543

Phone

Send us a message

We’d love to hear from you. Fill out the form below.