PRE-FORECLOSURE HELP IN ROGERS, ARKANSAS

You Know This City. You Know These Hills.

If you’ve lived in Rogers for any length of time, you understand what makes this corner of Northwest Arkansas different. You’ve driven I-49 through the heart of the city, past Pinnacle Hills Promenade on those busy weekends when it seems like all of Benton County is out shopping. You’ve taken your kids to Lake Atalanta to hike the trails or throw a disc on the course, watching the morning mist rise off the water with the Ozark hills rolling into the distance.

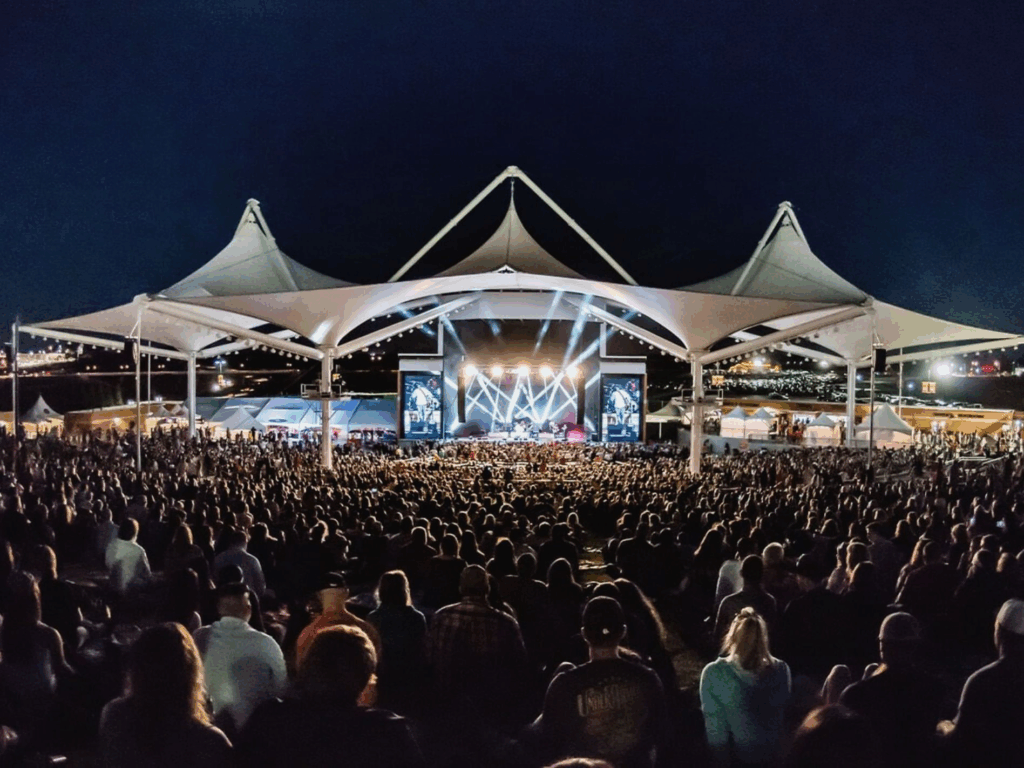

You know the rhythm of this place. The way Historic Downtown comes alive during First Friday with the brick storefronts glowing warm and families strolling. The pride when you mention you’re from Rogers and people immediately think of Daisy – “the BB gun place” – that piece of Americana that’s been made here since 1958. The summer nights at Walmart AMP when a major concert comes through and you remember this isn’t just another small town – this is a city of over 70,000 that punches way above its weight.

Maybe you remember when Rogers was smaller, before Walmart turned Bentonville into a global headquarters and the whole region exploded with growth. Or maybe you moved here precisely because of that growth – for a job with one of the supplier companies, or for the quality of life that comes with Ozark beauty and big-city amenities, or because Rogers offered affordable homes in the fastest-growing region in Arkansas.

You might live in one of the newer developments near Pinnacle Hills, or in an older neighborhood closer to downtown where the streets are tree-lined and the homes have character. Maybe you’re out toward Beaver Lake where you can be on the water in ten minutes, or near the Razorback Regional Greenway where you can bike or walk all the way to Bentonville or Fayetteville.

This is a place where railroad heritage meets modern growth. Where you can visit the Frisco Railroad Museum in the morning, shop at world-class retail in the afternoon, and catch a sunset at Lake Atalanta in the evening.

So when you’re facing pre-foreclosure here in Benton County, it doesn’t feel like just a financial problem. It feels deeply personal. It feels like you’re losing your place in Northwest Arkansas’s boom, in this community that’s been building and growing and becoming something special. It feels like you’re failing in a city known for success.

What Pre-Foreclosure Feels Like in Rogers

In Rogers – part of the economic engine of Northwest Arkansas where it seems like everyone’s doing well – struggling financially can feel particularly isolating. You see the construction cranes, the new businesses opening, the packed parking lots at Pinnacle Hills. Everyone seems to be thriving in this growth economy.

Maybe you work for one of the Walmart suppliers, or in retail, or healthcare, or one of the businesses that relocated here. Maybe you bought when Rogers was booming and prices were climbing and it felt like the smart investment. Then something shifted – a job loss, unexpected medical bills, a divorce, helping family members, or just the reality that the cost of living climbed faster than your income.

You drive past Lake Atalanta or through downtown and feel the weight of what’s happening. You avoid certain places because you don’t want to run into neighbors or coworkers who might ask questions you can’t answer.

And here’s what’s crucial to understand: You’re not out of time yet. Pre-foreclosure means you still have options. It means the bank hasn’t taken your home. It means you can still breathe, think clearly, and make decisions that work for you and your family.

How Foreclosure Actually Works in Arkansas

Let’s walk through what’s really happening, because understanding the process helps reduce the fear. In Arkansas, most foreclosures are “non-judicial,” meaning your lender doesn’t have to go through the court system. This makes the process move faster than in some states.

The Arkansas Foreclosure Timeline

When You First Miss a Payment: Nothing dramatic happens immediately. The bank sends notices. You get phone calls. But they’re not rushing to foreclose – it’s expensive and time-consuming for them, so they’d rather work something out.

After 30-90 Days: The letters get more serious. Legal language like “default notice” or “intent to accelerate” appears. This is where many people start to panic and avoid opening mail. But you still have time to respond.

The Notice of Default and Intent to Sell: Under Arkansas law, your lender must send you written notice before they can sell your home. This notice must give you at least 30 days and clearly state:

- The total amount you owe

- The deadline by which you must pay to bring your account current

- A statement that if you don’t pay by that deadline, they intend to sell the property

This notice typically comes by certified mail. If you’re in one of Rogers’ neighborhoods – near Pinnacle Hills, in the historic areas closer to downtown, out toward Beaver Lake, anywhere in the city – you’ll get it. This is your official warning.

The Publication Requirement: Here in Benton County, the lender must also publish notice of the foreclosure sale in a local newspaper once a week for two consecutive weeks. The first publication must happen at least 20 days before the scheduled sale date. This is public notice – anyone can see it.

The Foreclosure Sale: If you haven’t been able to work something out or sell the property yourself, your home goes to public auction. In Arkansas, this typically happens at the county courthouse. For Benton County, that’s at the courthouse in Bentonville, just up I-49 from Rogers.

The sale is public, usually held on a weekday morning. Your home is sold to the highest bidder – sometimes that’s the bank itself, sometimes it’s an investor.

After the Sale: Once your home is sold at auction, you typically have to move out quickly. Arkansas doesn’t offer a long redemption period. What’s done is done, and it happens fast.

Here’s What Most People Don’t Realize

The non-judicial process can move faster than you think. But here’s the important part: at any point before that auction gavel comes down, you still have options. You can sell the house yourself. You can try to negotiate with the bank. You can explore a short sale if you owe more than the home is worth.

The key is not waiting until the last minute. Not because we’re pressuring you – we’re not – but because the earlier you act, the more choices you have.

Why Rogers Homes Are Different

Your home here isn’t like a house in a smaller Arkansas town or a generic suburb without character. Rogers properties are part of something bigger – the county seat of Benton County, the third-largest and fastest-growing city in Arkansas, the beating heart of Northwest Arkansas’s incredible growth story.

If you’re near Historic Downtown, you might live in one of those charming older homes where Rogers’ railroad roots show through – the neighborhood that existed before Walmart transformed this entire region. If you’re in the Pinnacle Hills area, you’re in the retail and commercial epicenter that draws people from across the region. If you’re toward Beaver Lake, you’ve got access to 28,000+ acres of pristine water and recreation that people drive hours to enjoy. If you’re along the Razorback Regional Greenway, you can bike 36 miles through some of the most beautiful landscape in Arkansas.

These aren’t just addresses. They’re places with memories – kids growing up with Lake Atalanta as their backyard playground, summer concerts at the AMP under Ozark stars, Saturday mornings at the farmers market downtown, discovering War Eagle Cavern just outside the city limits, teaching your kids to shoot their first BB gun and connecting it to Rogers’ Daisy heritage.

And here’s what matters right now: properties in Rogers have real value, even if you’re behind on payments, even if the house needs work. You’re in the fastest-growing city in Arkansas. You’re in Northwest Arkansas where Walmart’s headquarters has created one of the most dynamic economies in the South. You’re 20 minutes from Bentonville, 30 minutes from Fayetteville, right on I-49 with easy access to everything. You’re minutes from Beaver Lake and the natural beauty that makes this region special.

You’re in a city that’s added tens of thousands of residents in recent years and shows no signs of slowing down. Corporate relocations, supplier companies, retail growth, young families attracted to quality schools and parks and trails. People want to live here.

That means your home, even in pre-foreclosure, has value. And that value might be your way out.

The Weight You’re Carrying Right Now

Let’s be completely honest about what you’re going through: this is crushing. You’re probably not sleeping well. Every time you drive I-49 past all that growth and development, you feel the weight of what’s happening. Every unknown phone call makes your stomach drop. You avoid checking the mail because you’re terrified of what’s inside.

You’ve done the math a hundred times. You’ve stayed up late going over the numbers, trying to figure out where the money could come from. But the numbers don’t work, and that reality is devastating.

Maybe you’ve thought about asking family for help, but pride won’t let you, or you don’t want to burden them. Maybe you’re embarrassed because everyone around you seems to be riding Northwest Arkansas’s growth while you’re drowning. In a community this size where you see familiar faces at Walmart or Pinnacle Hills or Lake Atalanta, it feels like there’s nowhere to hide.

If you’re married, this is probably causing serious tension. If you’re alone, the isolation might be unbearable.

You might be praying about it, trying to maintain faith that somehow this will work out – and some days that brings peace, and some days the fear overwhelms everything.

Here’s what we need you to hear: This situation doesn’t define who you are. You’re not a failure. You’re not irresponsible. You’re not less worthy than the people whose houses look perfect. You’re a person facing an incredibly difficult situation, and you’re trying to determine the best course of action.

The fact that you’re reading this right now – that you’re actively looking for solutions instead of just giving up – shows real courage. Many people in your situation simply shut down and ignore the problem. You’re not doing that. You’re here, trying to understand your options. That matters more than you realize.

Your Options

There’s no urgency here. No one’s going to pressure you. We just want you to understand what’s actually possible.

Option 1: Catch Up on Payments

If you’ve come into some money – an inheritance, a work bonus, help from family – you can pay what you owe and get current. This stops the foreclosure immediately. If this is possible, wonderful. Problem solved.

But if you’re reading this, it’s probably because that’s not realistic. And that’s okay. There are other paths.

Option 2: Loan Modification or Forbearance

You can try working with your lender to modify your loan. Sometimes they’ll lower your payment, extend the term, defer part of what you owe, or rarely, reduce the principal. Sometimes they’ll agree to forbearance – pausing or reducing payments temporarily.

This can work, but it’s slow and bureaucratic. Extensive paperwork. Long phone calls. Waiting. And no guarantee they’ll approve anything.

If you want to try this, we support that. But understand it takes time, and time might be something you’re running short on.

Option 3: Sell Your Home Yourself (Traditional Sale)

If you have equity – meaning it’s worth more than you owe – you could list with an agent and try a traditional sale. You’d pay off the mortgage, cover closing costs and agent commissions (5-6%), and keep what’s left.

The challenge? Traditional sales take time. Even in Rogers with its strong market demand, it could take weeks or months to find a buyer. And if you’re in pre-foreclosure, you might not have that time. Plus, getting your house show-ready can feel overwhelming when you’re already stressed.

Option 4: Short Sale

If you owe more than it’s worth, a short sale might be an option. The bank agrees to let you sell for less than the full balance. They take a loss, but it’s better than foreclosure for them.

Short sales can help you avoid foreclosure on your credit, but they’re complicated and slow. The bank has to approve every step, which can take months. And you need a buyer willing to wait.

Option 5: Sell Directly to a Cash Buyer

This is where we come in, and it’s the option that brings the most relief.

Here’s how it works: We buy houses directly, in any condition. You don’t fix anything. You don’t clean anything. You don’t stage it or wait months or deal with bank approval.

We look at your home and situation, and we make you a fair cash offer. If you accept, we handle everything – paperwork, title work, closing. You can close in as little as a week or two if needed, or on your timeline if you need more time.

No agent commissions. No closing costs from your pocket. No judgment.

You walk away without the mortgage weight, without the foreclosure on your record, and you can start fresh.

Why People in Rogers Choose This Route

We’ve worked with families all over Benton County – people near Pinnacle Hills, in the historic neighborhoods, out toward Beaver Lake, in newer developments. Here’s what they tell us:

“We just needed it to be over.” The constant stress was too much. Selling quickly gave them immediate peace of mind.

“We didn’t have the money to fix it up.” Many homes in pre-foreclosure need repairs. Selling to us meant they didn’t have to come up with thousands they didn’t have.

“We didn’t want it to be public.” In Rogers where community connections matter, a foreclosure at the Bentonville courthouse feels painfully public. Selling privately kept their business private.

“We wanted to stay in Northwest Arkansas.” Some needed to sell but wanted to stay in the area for work or family. A quick sale made that possible without months of stress.

“The house was too much after the divorce.” Life changes sometimes mean the home doesn’t fit anymore. Selling let them move to something more manageable.

What Makes Rogers Special

Let’s talk about this city, because it deserves recognition.

Rogers started in 1881 when the St. Louis-San Francisco Railway – the Frisco – came through Northwest Arkansas. Captain Charles Warwick Rogers, vice president of the railroad, gave his name to the new town. The railroad made Rogers a shipping center for the Ozarks’ timber, apples, and agricultural products. By 1920, Rogers had become the largest town in Benton County.

For decades, Rogers was a railroad town – solid, stable, connected to the broader world by those Frisco tracks. The brick buildings downtown still tell that story. The Frisco Railroad Museum preserves that heritage.

Then in 1958, something significant happened: Daisy Manufacturing Company moved its headquarters from Michigan to Rogers. The Daisy BB gun – that icon of American childhood, the “you’ll shoot your eye out” legend – became a Rogers product. For generations of American kids, their first gun was made right here.

But the transformation that really changed everything came from just up the road. When Sam Walton built Walmart into a global empire from Bentonville, the entire region exploded with growth. Supplier companies relocated to be near Walmart headquarters. Corporate jobs flooded in. The population surged. Infrastructure followed.

Rogers was perfectly positioned to ride this wave. As Benton County’s seat, it was already the governmental center. Now it became a retail powerhouse. Pinnacle Hills Promenade opened in 1997 and became Northwest Arkansas’s premier shopping destination, drawing crowds from across the region. The city built Lake Atalanta Park and the Rogers Aquatics Center. The Razorback Regional Greenway connected Rogers to its neighboring cities with 36 miles of trails. Walmart AMP brought world-class entertainment.

Today, Rogers is the third-largest city in Arkansas with over 70,000 people and the fastest-growing city in the state. It’s the county seat of Benton County. It’s home to corporate headquarters like Daisy and America’s Car-Mart. It’s 15 minutes from Beaver Lake’s 28,000+ acres of pristine water. It’s part of the Northwest Arkansas metro that’s one of the fastest-growing regions in America.

This is a city where railroad heritage meets modern growth. Where small-town character combines with big-city amenities. Where you can hike Ozark trails in the morning and shop world-class retail in the afternoon. Where the BB gun factory sits alongside cutting-edge corporate offices.

If your home is part of this place – whether it’s in a historic neighborhood that remembers the railroad days, or a modern development riding the growth wave, near Lake Atalanta’s natural beauty or along the Greenway’s trail system – it has value. Real value to someone who wants what Rogers and Northwest Arkansas offer.

And that includes us.

No Pressure. No Games. Just Honest Help.

We’re not here to pressure you. We’re not going to tell you that you have to decide today, or use high-pressure tactics. That’s not how we operate.

What we are here to do is offer you an option that might bring some relief. If you want to talk, we’ll listen without judgment. If you have questions, we’ll answer them honestly. If you need time to think it over, take all the time you need.

This is your home. Your decision. Your life. We’re just here to help if that’s what you want.

What Happens If You Reach Out

If you decide to call or fill out the form, here’s exactly what happens:

- We’ll have a conversation. No sales pitch, no pressure. Just an honest discussion about your situation and what you’re hoping to accomplish.

- We’ll come look at your property. If you’re comfortable, we’ll schedule a time to see the house and ask some questions.

- We’ll make you a fair cash offer. Usually within 24-48 hours, we’ll present an offer in writing. No obligation. If it works for you, great. If not, that’s fine too.

- You take whatever time you need. Think about it. Pray about it. Talk it over with family. We’ll be here when you’re ready.

- If you accept, we handle everything. We work with a local title company, take care of all paperwork, and make the process as smooth as possible.

This Isn’t the End of Your Story

Whatever happens with this house, it’s not the end. You’re going to be okay. That might be hard to believe right now, but it’s true.

Losing a home is one of the hardest things a person can go through, especially in a place like Rogers where home and community are deeply connected. But this moment doesn’t define who you are.

People come back from this. People rebuild their lives, their credit, their sense of home. People find new places, new communities, new peace. You will too.

Right now, you just need to take the next step. And if that next step is reaching out to us, we’ll be here.

You can call us at [YOUR PHONE NUMBER] or fill out the short form below. We typically respond within a few hours during normal business hours, and we’ll proceed at whatever pace feels comfortable for you.

You’re going to get through this. You’re going to be okay. Let’s figure this out together.

Frequently Asked Questions

What is pre-foreclosure and how does it work?

Pre-foreclosure is that critical window between when you fall behind on mortgage payments and when your home is actually sold at public auction at the Benton County courthouse in Bentonville. Think of it as the warning phase – the bank has started the legal foreclosure process, but your home still legally belongs to you and you still have the power to make decisions. Here in Arkansas, this process typically begins after you’ve missed several monthly payments and your lender sends you an official Notice of Default and Intent to Sell, which by law must give you at least 30 days before any sale can happen. During pre-foreclosure, you still live in your home, you’re still the legal owner, and most importantly, you still have options and control over the outcome. In Benton County, you’ll see the foreclosure notice published in a local newspaper for two consecutive weeks, and that publication must happen at least 20 days before the scheduled auction date. This window of time – which can be anywhere from a few weeks to a few months depending on where you are when you take action – is your opportunity to do something. You can catch up on payments if you can come up with the money, you can try to work out modified terms with your lender, or you can sell the property on your own terms before the bank takes control and auctions it off. Pre-foreclosure feels absolutely terrifying because the legal language makes it sound final and inevitable, but that’s not true. It’s the period when you still have the most options and control. The key is recognizing you’re in pre-foreclosure and taking action while you still have time, rather than letting fear and overwhelm paralyze you into doing nothing and hoping the problem will somehow go away, which it never does.

Can I sell my house during pre-foreclosure?

Absolutely yes, and in fact selling during pre-foreclosure is often one of the smartest decisions you can make. It’s completely legal, completely common throughout Benton County and Rogers, and it can save you from having a foreclosure on your credit report for seven years. Your home is still legally yours until that auction actually takes place at the courthouse in Bentonville, which means you have every right to sell it just like any other time – the only difference is you need to move faster than a traditional sale typically allows. Here in Rogers, if you listed your home near Pinnacle Hills or in the historic neighborhoods or out toward Beaver Lake with a regular real estate agent, you’d probably wait several weeks or even months for the right buyer, and your house would need to be in good showing condition throughout that time. But when you’re in pre-foreclosure, you don’t have months to wait, and you probably don’t have the money or emotional energy to make repairs, stage perfectly, and keep it show-ready. That’s exactly why selling directly to a cash buyer makes so much sense. We can close in as little as 7-10 days if time is critical, which gives you plenty of time to pay off the mortgage before the foreclosure sale. You walk away without the foreclosure hitting your credit report and damaging your score for seven years. Plenty of homeowners throughout Rogers and Benton County have sold during pre-foreclosure and moved forward with their dignity and credit relatively intact.

How long do I have before my house goes to foreclosure?

The honest answer is it depends on where you are in the process, but Arkansas doesn’t give you as much time as some states, so you need to take this seriously. Once your lender sends that official Notice of Default and Intent to Sell, Arkansas law requires them to give you at least 30 days before they can schedule the auction. But here’s what catches people off guard – by the time you receive that official notice, you’ve usually already been behind for several months. Most lenders don’t start formal foreclosure proceedings until you’re 90-120 days delinquent. So from your very first missed payment to the actual foreclosure auction at the Benton County courthouse in Bentonville, you might have four to six months total. But the second half – once you’ve received the official notice – moves very quickly. Once that notice gets published in the newspaper for two consecutive weeks as required, you’re really down to the final countdown. If you’re reading this and you’ve already received that notice with a sale date, don’t waste another week hoping things will work out. You probably have a few weeks left, maybe a month or two at most. That’s enough time to sell if you act now, but not enough time to procrastinate. Every day you wait is one day closer to losing all options. If you’re earlier in the process – just received your first default letter or still in that 60-90 day delinquent stage – you have more breathing room, but you should still treat it seriously and start exploring options now while you still have some control.

Will selling my house in pre-foreclosure stop foreclosure?

Yes, it absolutely will – if you sell in time and for enough to cover what you owe. When you sell and use the proceeds to pay off the mortgage in full, the foreclosure process stops immediately because there’s nothing left to foreclose on. The debt is satisfied, the bank gets their money, you get whatever equity remains after paying off the loan and closing costs, and it’s over. Your credit report will show the late payments you made before selling, and those do affect your score, but you avoid the actual foreclosure, which is far more damaging and stays on your report for seven years. Even if your home is worth less than you owe – which happens, especially if you bought during a high market – selling can still stop foreclosure if your lender agrees to a short sale, where they accept less than the full balance. We’ve helped many homeowners in Rogers and Benton County do exactly this – we negotiate with their bank so they can sell, pay off what they can, and walk away without the foreclosure hanging over them. The key is acting while you still have time. Once that auction date is set in Bentonville and you’re down to the final days, it becomes much harder or impossible to coordinate everything. But if you reach out early enough while you still have a few weeks or a month or more, selling is absolutely an effective way to stop foreclosure and move forward with a cleaner financial slate.

What happens if I do nothing during pre-foreclosure?

If you do nothing, the process moves forward on its own, and it doesn’t end well. Your lender will continue with foreclosure proceedings, your home will be sold at public auction at the Benton County courthouse in Bentonville, and you’ll lose the house. Depending on what it sells for at auction and what you owed, you might still owe money – Arkansas allows deficiency judgments, meaning if your house sells for less than your mortgage balance, the bank can sue you for the difference and potentially garnish your wages or bank accounts. So you lose your home and might still owe thousands. The foreclosure goes on your credit report and destroys your score, typically dropping it by 200-300 points or more, making it incredibly difficult for seven years to rent a decent place, get a car loan, qualify for another mortgage, or even get certain jobs that check credit. If you’re still living there until the sale, you’ll be forced out, and if you don’t leave voluntarily, the new owner can start eviction proceedings, adding another black mark. Beyond financial consequences, there’s the emotional and social toll, especially in Rogers where community connections matter and professional circles overlap. A foreclosure sale is public record – people might see the notice published, neighbors might notice when you suddenly move, and in Northwest Arkansas’s tight-knit business community, it’s harder to keep private. On a personal level, doing nothing usually comes from feeling completely paralyzed – feeling ashamed, not knowing where to turn, being too scared or proud to ask for help. But that paralysis only makes the outcome worse. The hardest part is taking that first step and making that first call, but once you do, you’ll discover more options and more people are willing to help than you realized. Doing nothing guarantees the worst outcome. Doing something – even just reaching out for a conversation – opens up real possibilities for a better ending.

Will selling to you hurt my credit less than a foreclosure?

Yes, significantly less damage. A foreclosure stays on your credit report for seven years and causes massive, devastating damage – often dropping your score by 200-300 points or more. Selling your home, even when behind on payments and in pre-foreclosure, shows you took responsibility and resolved the debt rather than walking away. You’ll still have a record of the late payments you made before selling, and those do negatively affect your score, but the impact is nowhere near as catastrophic as an actual foreclosure. Many lenders, landlords, and employers who check credit view someone who proactively sold their home to avoid foreclosure much more favorably than someone who let it go to auction without trying to resolve it. It demonstrates character, responsibility, problem-solving ability, and integrity even in extremely difficult circumstances. That distinction can make a real, tangible difference when you’re trying to rent your next place, apply for a car loan, or start rebuilding your financial life. The difference between having late payments on your record versus having a full foreclosure is the difference between “this person hit a rough patch but handled it responsibly” and “this person abandoned their obligations.” That perception matters, and it can affect your opportunities for years to come.

What if I owe more than the house is worth?

We can still help you even if you’re underwater on your mortgage, and this situation is more common than you think – you’re not alone. Sometimes we can work directly with your lender to negotiate what’s called a short sale, where they agree to accept less than the full mortgage payoff amount because it’s still financially better for them than going through the entire foreclosure process. We’ve successfully done this many times with banks and mortgage companies of all sizes, and we understand how to navigate the process.

need, how long it usually takes, and how to present your situation in a way that’s most likely to get approved. It does take some time and patience because the bank has to review everything and make an approval decision, but it’s absolutely possible, and it’s still much better for your credit and your financial future than letting the foreclosure happen. Even in cases where we can’t get the bank to agree to a short sale, having an honest conversation about your situation and your options is valuable. We can at least help you understand where you stand and what your realistic choices are, which is better than facing this alone and in the dark.

Do I have to pay any fees or commissions?

No, you don’t pay anything at all. We don’t charge any fees of any kind, and there are no real estate agent commissions that come out of your proceeds like there would be with a traditional sale. We make you an offer based on the property and your situation, and if you accept that offer, the number we quote you is the actual amount you receive. We cover all the normal closing costs on our end. What we offer is exactly what you get. There are no surprises, no hidden fees, no last-minute deductions, no fine print. Just a straightforward, honest transaction. This is completely different from listing with an agent where you’d typically pay 5-6% in commissions plus various closing costs that can add up to thousands of dollars. With us, those costs don’t come out of your pocket.

How quickly can we close?

As fast as you need us to move, or as slow as works better for your situation. We can close the sale in as little as 7-10 days if time is absolutely critical and you’re up against a foreclosure deadline. Or we can wait a few weeks or even longer if you need more time to figure out your next living situation, find a place to rent, arrange for movers, coordinate with your family, or just emotionally prepare for the transition. We work entirely on your timeline and what works best for you. We’re completely flexible because we understand everyone’s situation is different. Some people need the speed and certainty of a quick close. Others need a little breathing room to plan their next move. Whatever you need, we’ll do our best to accommodate.

What if my house needs a lot of work?

It doesn’t matter to us at all – we buy houses in absolutely any condition imaginable. We’ve bought beautiful homes near Lake Atalanta that just needed updating, and we’ve bought houses that needed new roofs, new HVAC systems, foundation repairs, complete kitchen and bathroom renovations, homes with code violations, homes with serious structural issues – you name it, we’ve seen it and bought it. You don’t have to fix a single thing. You don’t have to paint, repair, update, or even clean. We buy the house exactly as it sits today. That’s our job to deal with after we buy it, not yours. The condition of your home doesn’t change our willingness to help you – it just factors into the fair offer we make. If you’re worried that your house is “too much of a mess” or needs “too much work” for anyone to want it, please don’t let that stop you from reaching out. We’ve seen it all, and we’re not judging.

Can I stay in the house for a little while after we close?

In many cases, yes, we can absolutely work that out. If you need a few extra days or even a couple of weeks after closing to move out and get settled in your next place, we can often build that into the agreement as what’s called a “rent-back” period or “post-closing occupancy.” Just let us know what you need and what your timeline looks like, and we’ll do our best to accommodate your situation. We understand that moving is stressful and takes time to coordinate properly, especially when you’re already dealing with financial stress. The last thing we want is to add to that stress by forcing an unrealistic move-out timeline. Your comfort and dignity matter to us, and we’re willing to be flexible to help make this transition as smooth as possible for you and your family.

What parts of Benton County do you cover?

All of it, every part of the county. Whether you’re in Rogers proper near Pinnacle Hills, in the historic neighborhoods downtown, out toward Beaver Lake, or in Bentonville, Bella Vista, Centerton, Cave Springs, Lowell, Pea Ridge, or anywhere else in Benton County, we’re genuinely interested in helping. We work throughout the entire county and the broader Northwest Arkansas region. Location doesn’t matter to us – if you’re facing pre-foreclosure in Benton County, we want to talk with you. We know this area well, we understand the local market, and we’re committed to helping homeowners throughout the region find solutions that work for their unique situations.

Take a Breath. You’ve Got This.

You’ve made it all the way through this entire page, which means you’re seriously considering your options and actively seeking a way forward. That’s genuinely good. That’s important.

Whatever you ultimately decide to do, please know that you’re not alone. Thousands of people have been exactly where you are right now – feeling that same fear, that same shame, that same overwhelming uncertainty – and they found a way through it. You will too.

If you want to talk with someone who will listen without any judgment and help you understand your options clearly and honestly, we’re here. No pressure. No sales tactics. No games. Just an honest, respectful conversation.

Titan Property Investors

Your trusted partner in real estate

Address

731 S. 7th St.

Heber Springs, AR 72543

Phone

Send us a message

We’d love to hear from you. Fill out the form below.