Pre-Foreclosure Help in Jackson, Tennessee

West Tennessee’s Forgotten Middle

Jackson sits in the middle of West Tennessee, an hour from Memphis, two hours from Nashville, not quite close enough to either to benefit from their growth. For decades, Jackson was the regional hub—the place smaller towns looked to for jobs, shopping, healthcare, and education. Union University, Jackson State Community College, major hospitals, and manufacturing plants. A solid, stable, working-class city where people could build decent middle-class lives.

Then the factories started closing. The retail sector shifted. The population that had been growing stopped growing, then started shrinking. Young people left for Memphis or Nashville where opportunities seemed better. What’s left is a city trying to figure out its identity and purpose while dealing with the economic reality of post-industrial Middle America.

If you’re facing foreclosure in Jackson, you’re probably dealing with some version of this larger story. Maybe you work at one of the remaining factories or warehouses and the hours got cut. Maybe you work at a hospital or nursing home—essential work that doesn’t pay enough to cover bills when everything gets expensive. Maybe you’re retired and living on fixed income while property taxes and utilities keep climbing. Maybe you bought your house twenty years ago when Jackson’s economy was stronger and you thought you’d always be able to afford it.

Here’s what you need to know: Jackson’s housing market is complicated. Prices are lower than Nashville or Memphis, but that doesn’t mean selling is easy. The market is slower. Buyers are fewer. But options still exist, and you’re not out of time yet.

Pre-foreclosure means you still have choices. The bank hasn’t taken your house. You can still make decisions about how this ends. Let’s talk about what those options actually are in Jackson’s specific context.

Understanding Jackson’s Economic Reality

Before we talk about foreclosure timelines and solutions, you need to understand what makes Jackson different from Tennessee’s growing cities, because these differences affect your options dramatically.

The Post-Industrial Struggle

Jackson was built on manufacturing. Procter & Gamble (which closed in 2023 after 64 years). Electrolux (which shut down in 2011). Pringles plant (which was part of P&G). Various automotive suppliers, parts manufacturers, the kinds of factories that provided good-paying union jobs with benefits.

Those jobs are mostly gone now. The plants closed or moved to Mexico or automated away the workers. What replaced them pays less and offers fewer benefits. Warehouses and distribution centers instead of manufacturing. Service jobs instead of making things. The economic foundation of the city eroded.

This matters for your foreclosure situation because:

Income levels are stagnant or declining. The good factory jobs that paid $20-25/hour with overtime are gone. The replacement jobs pay $12-15/hour. People are working just as hard but earning less in real dollars.

Unemployment is higher than state average. When factories close, not everyone finds new work. Some people leave Jackson. Others cycle through temporary jobs or give up looking.

The buyer pool for houses is limited. Young professionals who would buy starter homes are leaving Jackson for cities with better opportunities. What’s left are mostly people struggling financially, people on fixed incomes, and investors looking for cheap rentals.

The Healthcare Economy

Healthcare is now Jackson’s largest employment sector. Jackson-Madison County General Hospital (now West Tennessee Healthcare), multiple nursing homes, medical practices, home health agencies. Thousands of people work in healthcare.

But here’s the reality: Healthcare doesn’t pay enough for most workers.

If you’re a CNA, med tech, hospital housekeeper, nursing home aide, home health worker—you’re doing essential work for $11-14/hour. Maybe $15-16 if you’ve been there for years. That’s $25,000-30,000 per year. Try buying a house and covering all your bills on that income in an economy where everything costs more than it used to.

Even RNs and other licensed professionals, who make decent money, are often stretched thin by the cost of living, student loans, and family obligations.

You’re not failing if you work in healthcare and can’t make your mortgage. You’re dealing with an economy that doesn’t value essential workers financially even though it depends on them completely.

The Retail Apocalypse Hit Jackson Hard

Jackson was a regional retail hub. Old Hickory Mall brought shoppers from surrounding counties. Downtown had department stores. The commercial strips along Highland Avenue and Vann Drive were full.

Then came Amazon, online shopping, and the general decline of brick-and-mortar retail. Old Hickory Mall is half-empty now—Sears closed, JCPenney closed, other anchors gone. Downtown retail never recovered from the mall’s arrival and now has to compete with online shopping. The big box stores on the edges survive, but the middle ground collapsed.

This means:

Lots of retail workers lost jobs or saw hours cut to part-time to avoid paying benefits.

Service industry jobs dried up as restaurants and shops closed.

The economic multiplier effect disappeared—when retail workers and factory workers lose jobs, they stop eating at restaurants, getting their hair cut, buying things locally. The whole economy shrinks.

The Fixed-Income Squeeze

Jackson has a significant population of retirees and people on disability. Social Security, disability payments, small pensions. Fixed incomes that don’t increase when costs do.

Property taxes are increasing as the city and county try to maintain services with a shrinking tax base. Even though Jackson home values are low compared to Nashville, the tax burden feels heavy when your income is fixed.

Utilities are expensive. Electric and gas bills. Water and sewer. Internet (necessary now, not optional). These costs eat into fixed budgets.

Healthcare costs are crushing for retirees even with Medicare. Supplemental insurance, prescriptions, co-pays, the things Medicare doesn’t cover—it adds up to hundreds per month.

If you’re on fixed income and behind on your mortgage, you’re not bad with money. You’re dealing with an economy designed to extract money from people who don’t have any to spare.

The Education Paradox

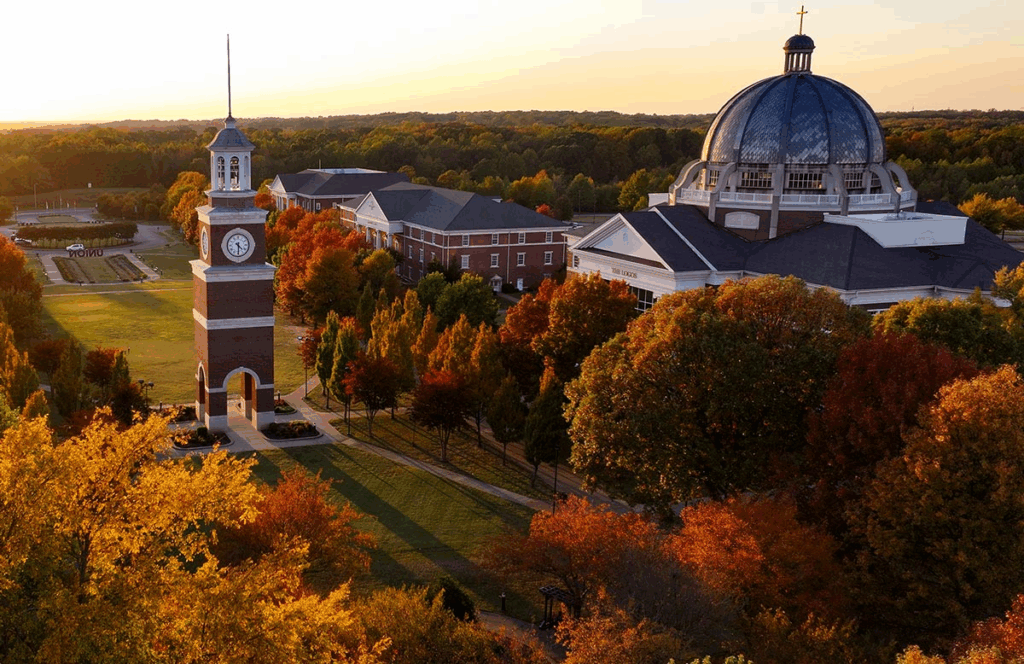

Jackson has good educational institutions—Union University (private Christian), Jackson State Community College, University of Memphis-Lambuth campus. These should be economic engines bringing students and stability.

But many students come from elsewhere, and many leave after graduation. Brain drain is real. The educated young people Jackson produces or educates often leave for bigger cities with better job markets.

This affects housing because first-time homebuyers—typically young couples starting careers—are fewer and fewer. The people who would normally buy starter homes are leaving Jackson or can’t afford to buy.

The Weight You’re Carrying

Let’s talk about what you’re actually feeling, because foreclosure in a declining city carries different emotional weight than foreclosure in a booming city.

The “Nobody Cares” Feeling

In Nashville or Memphis, when you’re struggling financially, at least you can tell yourself it’s because those cities are expensive and booming and you’re just caught in the growth. There’s almost dignity in being priced out of a hot market.

In Jackson, there’s no such narrative. Jackson isn’t booming. It’s declining. Houses are cheap compared to other cities. If you can’t afford a Jackson house, where can you afford?

The struggle feels more shameful because Jackson is supposed to be affordable. If you’re failing here, it feels like you’re failing at the easiest level.

The truth: Jackson’s “affordability” is relative. Low home prices don’t mean anything if wages are even lower and jobs are scarce. You’re not failing. The local economy is failing.

The Isolation of Economic Decline

In growing cities, you’re surrounded by construction, new businesses, optimism, the sense that things are improving even if you’re not sharing in the improvement.

In Jackson, you’re surrounded by closed factories, empty storefronts, deteriorating buildings, population decline. The visible evidence that things aren’t getting better. It’s depressing and isolating.

When you’re facing foreclosure in this context, it feels like confirmation that you’re on the wrong side of history. Like you should have left when others did. Like you’re stuck in a place with no future.

The reality: Jackson is home. Maybe you have family here. Maybe your kids are in schools here. Maybe you have a community here. Maybe you can’t afford to move to an expensive city. You’re not stupid for staying. You’re dealing with limited options in a difficult situation.

The Healthcare Worker Burnout

If you work in healthcare—which many Jackson residents do—you’re dealing with specific stresses that contribute to financial crisis.

The work is physically and emotionally exhausting. Long shifts. Heavy patients. Death and suffering. COVID made everything worse. Burnout is epidemic.

The pay hasn’t kept up with the demands. You’re doing more work with fewer staff for the same or barely higher wages.

You can’t afford to quit because you need the insurance, you need the income, you have bills. But you’re running on empty.

When you fall behind on your mortgage, it’s not because you’re lazy. It’s because you’re exhausted and underpaid and trying to survive in a system that exploits essential workers.

The Generational Homeowner Stress

Maybe you inherited your parents’ house. They paid it off over decades. Left it to you thinking they were giving you security.

But now you’re responsible for the property taxes, the insurance, the maintenance on an aging house. You might have your own mortgage somewhere else, or rent you’re paying. The inherited house is supposed to be an asset but it feels like a burden.

Or maybe you bought your house decades ago. Raised your family there. Thought you’d retire there. But now you’re older, your income dropped, the maintenance costs are overwhelming, and you can’t afford to stay in the house you’ve lived in for thirty years.

Losing your family home—especially if it’s been in the family for generations—carries grief that goes beyond financial loss. This is identity, history, memory. The place where people were born and died. Where holidays happened. Where life was lived.

That grief is real and valid. You’re allowed to mourn.

The Comparison to Memphis and Nashville

You hear stories about Memphis and Nashville. Houses selling for crazy prices. People making good money. Opportunities.

And you’re in Jackson, watching your house go into foreclosure, wondering if you made a mistake staying.

The comparison is unfair to yourself. Memphis and Nashville have their own problems—crime, cost of living, traffic, stress. The grass isn’t necessarily greener. You made the best choices you could with the information and circumstances you had.

The Hidden Struggles Nobody Talks About

There are aspects of life in declining post-industrial cities that people in booming metros don’t understand. Let’s talk honestly about what you’re dealing with.

The Brain Drain You’re Living Through

Your smart, ambitious kid graduated high school. Maybe went to Union or Jackson State, maybe went away to college. Either way, they’re probably not staying in Jackson.

They’re moving to Nashville or Memphis or Atlanta or somewhere with opportunities. They’re part of the educated exodus that’s been happening for decades. Not because they don’t love home. Because the jobs aren’t here for what they studied. Because they can’t build the future they want in a declining economy.

And you’re happy for them—you want them to succeed. But you’re also sad because you’re watching your children leave, watching the next generation abandon the place you’ve built your life.

When you’re facing foreclosure, you might wonder if you should have left too. If you made a mistake staying in a place that’s losing its young people. If you’re on the wrong side of economic history.

The truth: You made the best choice you could with your circumstances. Family ties matter. Community matters. Affordability matters. Not everyone can pick up and move to expensive cities. You’re not wrong for staying.

The Walmart Economy Trap

When the factories closed, Walmart and similar big boxes became major employers. They hire hundreds of people. They’re always hiring because turnover is constant.

But here’s the reality of Walmart-economy work:

Hours are unpredictable. One week you get 35 hours. Next week you get 18. You can’t budget. You can’t plan. You’re constantly stressed about whether you’ll make enough to cover bills.

Wages are low. $12-13/hour. Maybe $14 if you’ve been there forever. That’s $25,000-28,000 per year at full-time. But you’re not getting full-time consistently because that would require them to give you benefits.

Benefits are minimal. The health insurance is expensive with high deductibles. Most people can’t afford to use it even when they have it.

The work is physically demanding. Standing all day. Lifting. Moving. Your body breaks down over time but you keep working because you have to.

You’re treated as disposable. Management makes it clear you’re replaceable. There’s always someone else who needs the job more desperately than you do.

If you’re working Walmart or similar and struggling with your mortgage, you’re not failing. You’re trying to survive on wages that haven’t kept pace with costs for decades. The system is broken, not you.

The Healthcare Worker Reality

We mentioned this earlier but it deserves expansion because so many Jackson residents work in healthcare.

CNAs and techs are making $11-14/hour to do backbreaking work caring for sick and dying people. Lifting patients. Changing bedding. Dealing with bodily fluids. Getting yelled at by patients with dementia. Going home exhausted and emotionally drained.

That’s $23,000-29,000 per year. Before taxes. Before health insurance (which you need). Before childcare (which costs almost as much as you make). Before student loans if you went to school to get the certification.

**RNs make better money—$55,000-70,000—**but they’re often drowning in student debt from nursing school. Many have BSN degrees that cost $40,000-60,000 to obtain. They’re paying $400-600/month in student loans while trying to support families and pay mortgages.

The staffing shortages mean mandatory overtime. You work your 12-hour shift then get forced to stay for another four hours because there’s no one to cover. You’re exhausted. You’re burnt out. But you can’t afford to quit because you need the insurance, the income, the stability such as it is.

COVID made everything exponentially worse. The trauma. The deaths. The working conditions. The public hostility and accusations. Many healthcare workers have PTSD from the pandemic but can’t afford therapy or time off to heal.

If you work in healthcare and you’re behind on your mortgage, you’re not irresponsible. You’re underpaid and overworked in a system that extracts maximum value from essential workers while compensating them minimally.

The Social Security Survival Math

If you’re retired and living on Social Security, you’re probably getting $1,500-2,000/month. Maybe less. Maybe a small pension on top of that if you’re lucky.

Let’s do the math:

- Social Security: $1,800/month

- Mortgage: $600/month

- Property taxes (escrowed): $150/month

- Homeowner’s insurance: $100/month

- Utilities (electric, gas, water): $250/month

- Medicare supplement: $150/month

- Prescriptions: $200/month

- Groceries: $300/month

- Car insurance: $80/month

- Gas: $100/month

- Phone: $50/month

That’s $1,980/month. You’re already over budget before car repairs, medical co-pays, home maintenance, or anything unexpected.

One unexpected expense—$800 for car repair, $500 for plumbing issue—and you’re behind on the mortgage. Miss two months and suddenly you’re in default.

You’re not living extravagantly. You’re not being irresponsible. You’re trying to survive on an income that was calculated decades ago and hasn’t kept pace with inflation.

The Inherited House Burden

Your parents worked their whole lives paying off their house. They died thinking they were leaving you something valuable. Security. Generational wealth.

Instead you got:

- A 60-year-old house that needs $30,000 in deferred maintenance

- Property taxes of $2,000/year you have to pay even though you’re not living there

- Insurance of $1,200/year

- A house you can’t sell because Jackson’s market is slow and buyers are scarce

- The guilt of letting it go because it was your parents’ pride and joy

You’re paying to maintain an empty house you can’t afford while also paying rent or mortgage on where you actually live. It’s crushing you financially but you feel obligated to the memory of your parents who worked so hard for it.

Sometimes the most loving thing you can do with an inherited house is let it go. Your parents would want you financially stable more than they’d want you sacrificing your own security for a house.

The Small-Town Gossip Factor

Jackson is small enough that people know people. Word gets around. If you’re in foreclosure, there’s a decent chance people you know will find out.

They’ll see the notice in the paper. They’ll hear about it at church or work or the grocery store. They’ll talk about it—not always meanly, sometimes with genuine concern, but they’ll talk.

The shame of financial failure in a small city where everyone knows everyone is heavy. You avoid people. You stop going to church. You isolate yourself because you can’t face the questions or the pity or the judgment.

But here’s what you need to know: Other people are struggling too. They’re just hiding it like you’re hiding it. The person judging you might be two months from foreclosure themselves. The person pitying you might be drowning in credit card debt or medical bills.

Your financial situation doesn’t define your worth as a person or as a community member. Anyone who judges you harshly for struggling during economic decline isn’t worth your concern.

The “Should Have Left” Regret

You watch the news about Nashville booming. You hear about Memphis opportunities. You see Facebook posts from high school friends who moved away and seem to be doing well.

And you wonder: Should I have left Jackson? Am I stupid for staying? Did I trap myself and my family in a declining city?

This kind of regret is corrosive. It eats at you. Makes you feel like every problem is your fault for making the wrong choice years ago.

Here’s the truth: Hindsight is always 20/20. You made the best choice you could with the information and circumstances you had at the time. Maybe you stayed because:

- Family was here and you couldn’t leave them

- You had a decent job and thought it would last

- Your kids were in school and you didn’t want to disrupt them

- You owned a house and it made financial sense to stay

- You loved your community and wanted to be part of it

- Moving to an expensive city wasn’t financially possible

Those were all valid reasons. The fact that Jackson’s economy declined doesn’t mean you were wrong to stay. It means circumstances changed beyond your control.

And leaving isn’t always better. Big cities have their own problems. Higher costs. More stress. Less community. Different doesn’t automatically mean better.

How Foreclosure Works in Tennessee

The legal process is the same throughout Tennessee, but the practical experience differs in Jackson’s market.

The Standard Tennessee Timeline

Months 1-3: You miss payments. Letters arrive. Phone calls come. The lender sends default notices. You’re required to be given opportunity to cure (catch up on payments).

Month 3-4: Formal Notice of Sale arrives. Tennessee law requires minimum 20 days before any auction. Sent certified mail and published in local newspaper—in Jackson, that’s The Jackson Sun.

The Publication Reality: In a city of 68,000 where many people know each other, newspaper publication can feel exposing. Your coworkers might see it. Your church members might see it. The shame is real.

The Sale: Auction happens at Madison County Courthouse downtown. Usually Tuesday morning. Public. Highest bidder wins.

After Sale: You must vacate. Tennessee has limited redemption rights. Once sold, it’s sold. No taking it back.

Deficiency Judgments: Tennessee allows them. If the house sells for less than you owe (very possible in Jackson’s market), the lender can sue you for the difference. You lose your house AND still owe money.

The Jackson Market Factor

Here’s where Jackson differs from Nashville or Memphis:

Houses don’t always sell at auction for full value. Jackson’s market is slow. Investor interest is limited. Your house might sell for significantly less than you owe, leaving you with deficiency judgment.

This makes avoiding foreclosure even more important. Selling yourself—even for less than you hoped—is better than letting it go to auction and owing the difference.

Foreclosures are unfortunately common in Jackson. Economic decline means more people struggling, more foreclosures. You’re not alone.

Jackson Neighborhoods: What You’re Dealing With

Where your house is in Jackson dramatically affects your options.

North Jackson

The areas off North Highland, toward the bypass. Newer subdivisions built in the 1990s-2010s. Where middle-class families moved for newer houses, better schools, safer neighborhoods.

Market Reality: Best market in Jackson. These houses sell faster than other areas. Still slow compared to Nashville or Memphis, but movement happens.

Buyer Pool: Families moving to Jackson for jobs, military families from nearby Milan Arsenal, people wanting newer construction.

Your Situation: If you’re here facing foreclosure, you likely have some equity. Traditional sale might work if you have time. These houses can sell.

East Jackson

Areas like Parkview, Carriage House, established neighborhoods from 1960s-80s. Older but well-maintained. Good bones. Where stable working families have lived for decades.

Market Reality: Moderate. Houses sell but slowly. Buyers are price-conscious. Looking for good value.

Buyer Pool: First-time buyers, families on budgets, people downsizing, some investors.

Your Situation: You probably have equity if you’ve been here long. House might need updates to sell quickly. Traditional sale possible but might take months you don’t have.

South/Downtown Jackson

Closer to downtown, older neighborhoods. Some historic homes. Mix of maintained and deteriorating properties. More economically diverse.

Market Reality: Slower. Some areas are improving with downtown revitalization efforts. Others struggling.

Buyer Pool: Investors looking for rentals or flips. Some people wanting historic character. Limited family-buyer interest.

Your Situation: Equity depends on specific location and condition. Traditional sale challenging. Cash buyer might be better option.

West Jackson

Mix of older residential and commercial. Some pockets nice, others rough. Very neighborhood-specific.

Market Reality: Challenging. Market is slow. Houses sit.

Buyer Pool: Limited. Mostly investors. Buyers are scarce and picky.

Your Situation: Traditional sale could take forever. Cash buyer probably your best option if facing foreclosure.

County/Rural Areas

Outside Jackson city limits. More land. Rural feel. Mix of nice properties and manufactured homes.

Market Reality: Very specific buyer pool. People want land and space. Market moves slowly.

Buyer Pool: Small. People looking for specific property types.

Your Situation: Traditional sale timeline uncertain. Depends on property specifics.

Your Real Options

Let’s talk about actual solutions specific to Jackson’s economic reality.

Option 1: Catch Up Completely

If you suddenly have money to pay everything you owe, great. Problem solved. This rarely happens. Moving on.

Option 2: Loan Modification

Contact your lender and request modification—lower rate, extended term, forbearance, principal reduction (rare).

The Jackson reality: Lenders know Jackson’s market is weak. They might be more willing to work with you than in hot markets because foreclosure means they’ll probably lose money. But they’re also less motivated because they know the property value is limited.

Worth trying. Document your hardship. Explain your situation. But don’t wait months for an answer that might be no.

Option 3: Traditional Sale

List with a Jackson realtor. Price competitively. Market it. Wait for buyers.

This works if:

- Your house is in North Jackson or another decent area

- House is in good condition or you can afford repairs

- You have 60-90+ days before foreclosure

- You’re patient and emotionally capable of dealing with a traditional sale

Challenges in Jackson:

- Market is slow—houses sit for months

- Buyers are scarce and picky

- Offers come in low—buyers know it’s a buyer’s market

- Financing falls through more often in weak markets

- Timeline is unpredictable

Costs:

- 5-6% commission on a $120K house is $6K-7K

- Closing costs $3K-4K

- Repairs buyers require

- Carrying costs while house sits on market

If you’re in North Jackson with decent house and time, traditional sale is worth considering. Otherwise, probably not realistic.

Option 4: Short Sale

If you owe more than the house is worth—entirely possible in Jackson where values have stagnated or declined—short sale might be necessary.

We can help with this. We’ve done short sales in Jackson. We understand the local market and lender dynamics.

Process takes months. Requires finding buyer willing to wait. Lender approval uncertain. But it’s better than foreclosure.

Option 5: Sell to Us for Cash

This is where we come in with a solution designed for Jackson’s market reality.

When selling to us makes sense:

- Time is short (foreclosure approaching)

- The house needs work you can’t afford

- Market is slow and you can’t wait months

- Traditional buyers aren’t interested in your area

- You need certainty over the maximum price

- You’re exhausted and overwhelmed

How it works:

- Contact us—phone or form

- We discuss your situation, timeline, what you owe

- We see your house (or virtual tour)

- We make written cash offer within 24-48 hours

- You decide if it works for you

- If yes, we handle everything—paperwork, title, closing

- Close on your timeline—7-10 days if urgent, longer if you need time

- You hand over keys and move forward

What you get:

- Certainty—no deal falling through

- Speed—fast when you need fast

- Simplicity—we handle complexity

- No repairs—as-is purchase

- No commissions or fees

- No showings or strangers walking through your house

- No waiting months hoping someone buys

What’s the catch?

- Our offer will be less than theoretical perfect-market retail value

- We need to account for repairs, holding costs, our risk and profit margin

- On a $100K house, our offer might be $75K-85K depending on condition and market

But consider:

- That “perfect retail value” assumes perfect buyer appears, pays top dollar, closes smoothly

- In Jackson’s market, that might not happen for months or at all

- After commission and costs, traditional sale nets you maybe $5K-10K more IF it works

- IF is doing a lot of work in that sentence

- Certainty and speed might be worth more than uncertain extra money

For many people in Jackson facing foreclosure, we’re the realistic solution.

Real Stories From Jackson Homeowners

These are actual situations we’ve dealt with in Madison County:

“Worked at Procter & Gamble for 22 years. When they closed, I was 54 years old. Couldn’t find anything that paid close to what I made. Fell behind on mortgage. You bought my house so I could move to Memphis where my daughter lives and I found work.”

“I’m a CNA at the nursing home. Make $13/hour. Husband drives truck but doesn’t have steady work. We bought our house when things were better. Now we can’t keep up. You bought it fast so we could move into something we can actually afford.”

“Inherited my mom’s house. Still had mortgage on it. I couldn’t afford two properties. Listed it with realtor—sat on market for five months, no offers. You bought it and I could finally close that chapter.”

“Retired schoolteacher. Property taxes doubled in ten years while my retirement income stayed the same. I was choosing between a mortgage and medicine. You helped me sell so I could move into senior housing I can afford.”

“The house needed a new roof, foundation work, and plumbing issues. Living on disability—don’t have $30,000 to fix everything. You bought it as-is.”

“Divorce. Neither of us wanted the house. Both of us just wanted out. You made an offer we could split and both move on with our lives.”

“Medical bills from my wife’s cancer buried us. Even with insurance, we owed $60,000. Trying to pay that plus the mortgage was killing us. Selling to you let us prioritize her health and get out of debt.”

Different situations. Different reasons. Same outcome: moving forward instead of staying trapped.

What Jackson Is

Understanding the city’s reality helps you make peace with your decision.

The History

Jackson was founded in 1822 and named after Andrew Jackson. Became important as railroad junction in the 1850s. Grew steadily as regional hub for cotton agriculture, then manufacturing in the 20th century.

For most of its history, Jackson was the city smaller West Tennessee towns depended on. The place you went for hospital care, shopping, entertainment, jobs. Population peaked around 70,000 in the 1980s.

The Present Reality

Today Jackson has about 68,000 people and has been declining slowly for decades. It’s still the largest city between Memphis and Nashville, still a regional hub, but diminished.

What Jackson has:

- West Tennessee Healthcare (major hospital system)

- Union University (2,300 students, Christian university)

- Jackson State Community College

- Toyota/Mazda plants in nearby Huntingdon (30 miles away)

- Distribution centers and warehouses

- Government services as county seat

- Some remaining manufacturing

What Jackson struggles with:

- Population decline and brain drain

- Factory closures and manufacturing job loss

- Retail decline and empty storefronts

- Higher than average poverty (about 25%)

- Aging infrastructure

- Crime in some areas

- Limited opportunities for young professionals

- Economic stagnation

Jackson is a city trying to find new identity after losing old one. It’s not Detroit-level bad. But it’s not thriving either. It’s stuck in uncomfortable middle—not growing, not completely collapsed, just… struggling.

What This Means for You

If you’re staying in Jackson, you’re staying in a place with challenges but also with community, affordability (relative to Nashville), and the chance to be part of potential renewal.

If you’re leaving Jackson, you’re making a practical choice based on economic reality. No shame in that. Sometimes you have to go where opportunity is.

What You Actually Need To Do Right Now

Stop reading. Start acting.

Contact Us

Tell us:

- Where in Jackson is your house?

- What condition is it in?

- What do you owe vs. what you think it’s worth?

- How much time before foreclosure sale?

- What matters most to you?

What Happens Next

Quick response: We get back to you within hours usually.

Real conversation: No pressure. No sales pitch. Just honest talk about your situation.

Property visit: We see your house (or virtual if needed).

Written offer: Within 24-48 hours. Clear terms. No obligation.

You decide: Take time. Think about it. Talk to family.

If you accept: We handle everything. You show up to closing, sign papers, hand over keys, move forward.

The Only Wrong Choice Is No Choice

Doing nothing guarantees the worst outcome. Foreclosure. Destroyed credit. Possible deficiency judgment. Having to move anyway but without any control.

Any action is better than paralysis.

You’re Going to Be Okay

Whether you stay in Jackson or leave, whether you keep this house or let it go, you’re going to be okay.

This situation doesn’t define you. Jackson’s economic decline isn’t your fault. Factory closures aren’t your fault. Low wages aren’t your fault. The healthcare system underpaying essential workers isn’t your fault.

You’re dealing with structural economic problems that are bigger than any individual’s choices or efforts.

Losing this house might hurt. It might feel like failure. But it’s not failure. It’s an adaptation. It’s recognizing when a situation isn’t working and making hard choices to change it.

People survive foreclosure. People move on. People rebuild. You will too.

Maybe you stay in Jackson and find more affordable housing. Maybe you move to Memphis or Nashville for opportunities. Maybe you move closer to family. Maybe you move to a smaller Tennessee town where costs are even lower.

Whatever comes next starts with dealing with this. Being honest. By taking action.

We’re here to help if you want help. No judgment. Just a possible path forward.

Frequently Asked Questions

Will foreclosure notices really be in The Jackson Sun?

Yes. Tennessee law requires newspaper publication. It’s public record. Some people will see it.

What if I work at the hospital—will this affect my job?

Foreclosure typically does not affect healthcare employment. Your job should be safe.

What if my house has been in my family for generations?

We understand that loss. We’ll treat your family home with respect. And sometimes letting go is the right choice even when it’s painful.

Jackson houses don’t sell fast—can you really close in a week?

Yes. We buy with cash—no financing contingencies. We can close as fast as title work allows.

What if my house needs major repairs?

We buy as-is. Condition doesn’t matter. We’ve bought houses that need everything.

My house is in a rough area—will you still buy it?

Yes. We buy throughout Jackson and Madison County regardless of neighborhood.

What if I’m underwater—owe more than it’s worth?

We can help with short sales. We work with lenders on these regularly.

How is your offer different from what a realtor would get me?

Realtor might get you slightly more in perfect conditions after 3-6 months. Might. In Jackson’s market, might not. Our offer is certain, fast, and done.

Make the Decision

You’ve read this far. You understand your situation and options.

The only question left: are you ready to act?

Fill out the form. Make the call. Start moving forward.

You’re going to be okay.

Titan Property Investors

Your trusted partner in real estate

Address

731 S. 7th St.

Heber Springs, AR 72543

Phone

Send us a message

We’d love to hear from you. Fill out the form below.