Pre-Foreclosure Help in Cookeville, Tennessee

The Small City That’s Not Quite Small Anymore

Cookeville sits almost exactly in the center of Tennessee—an hour from Nashville, an hour from Knoxville, perched on the Cumberland Plateau at the crossroads of I-40. For most of its history, Cookeville has been a classic small Tennessee city: Tennessee Tech University providing stability, some manufacturing, a regional shopping hub for surrounding rural counties, the kind of place where people know their neighbors and Friday night football matters.

Then something shifted. Nashville’s growth started pushing outward. Remote workers discovered Cookeville—close enough to Nashville for occasional commutes, far enough away to be affordable, with fiber internet through the city’s municipal broadband. Young families started moving here. The population began growing. Housing prices started climbing. What used to be a sleepy college town started feeling like a suburb of somewhere else.

If you’re facing foreclosure in Cookeville, you’re probably caught in this transition. Maybe you’re a longtime resident who watched housing costs increase while your wages stayed flat. Maybe you work at Tennessee Tech or at one of the hospitals, earning a stable but modest salary that used to be sufficient but isn’t anymore. Maybe you moved here from Nashville thinking you were making a smart financial choice, only to discover that Cookeville isn’t as cheap as you expected. Maybe you bought during the recent growth surge and the numbers just aren’t working.

Here’s what matters right now: You’re in pre-foreclosure, which means you still have control over the outcome. The bank hasn’t taken your house yet. You still have time to make decisions about how this situation ends.

Let’s discuss what your options actually are in Cookeville’s specific market—a city that’s grown enough to have housing pressure but hasn’t grown enough to have a robust resale market, where you’re competing with both local buyers and Nashville refugees, where prices have risen but not as dramatically as in larger cities.

Understanding Cookeville’s Evolving Housing Market

Cookeville’s housing market exists in an unusual space—it’s no longer a small, isolated market, but it’s not yet a major metro market either. This creates specific challenges and opportunities for homeowners facing foreclosure.

The Nashville Proximity Factor

Cookeville is 78 miles from Nashville—far enough that it’s not a practical daily commute for most people, close enough that it’s feasible for occasional trips or hybrid work schedules. This proximity shapes the housing market in important ways.

Remote workers from Nashville are moving here. People who can work from home discovered Cookeville during the pandemic. They bring Nashville incomes and pay prices that seem cheap to them but expensive to longtime Cookeville residents. This influx has pushed up housing costs throughout the market.

The commute is theoretically possible but practically difficult. Some people do commute to Nashville from Cookeville—about 90 minutes each way in good traffic. That’s 15 hours per week, nearly 800 hours per year. The time cost is enormous. The financial cost (gas, vehicle wear, toll roads if used) adds up to thousands annually. If you bought in Cookeville thinking you could maintain a Nashville job, the reality of that commute might be destroying your quality of life and your budget.

Housing costs have increased but not proportionally to Nashville. Yes, prices in Cookeville have risen. A house that sold for $150,000 ten years ago might be $225,000 now. That’s significant appreciation. But that same increase represents affordable housing to someone selling a $400,000 house in Nashville. The market absorbs buyers with different financial capabilities, which creates pricing pressure.

The Tennessee Tech Economic Anchor

Tennessee Tech University enrolls approximately 10,000 students. For a city of about 35,000, that’s a substantial percentage of the population. The university provides critical economic stability—steady employment, student housing demand, cultural amenities, resistance to economic downturns that hit manufacturing-dependent cities.

University employment means stability but not high wages. Faculty and staff positions provide reliable income and benefits, but with few exceptions, they don’t pay extraordinarily well. If you work at Tech, you have job security, but you’re probably not accumulating wealth rapidly. When housing costs increase faster than university salaries, financial strain develops.

Student housing creates a rental market. Approximately 7,000 of Tech’s students don’t live in university housing, which means they rent in the community. This creates demand for rental properties. If you’re facing foreclosure, converting your house to a rental might seem like a solution, but the student rental market is competitive, and being a landlord requires capital reserves many people don’t have when they’re already in financial distress.

Students and recent graduates don’t typically buy houses. The presence of 10,000 students means a large population that doesn’t contribute to homebuying demand. When they graduate, many leave Cookeville for larger cities with more career opportunities. This limits the buyer pool for your house.

The Manufacturing and Healthcare Employment Base

Beyond Tennessee Tech, Cookeville’s economy relies heavily on manufacturing (automotive suppliers, various production facilities) and healthcare (Cookeville Regional Medical Center, clinics, nursing homes, related services).

Manufacturing jobs provide middle-class incomes but face constant uncertainty. A production job at an automotive supplier might pay $18-22 per hour with overtime potential—enough to afford a modest house in Cookeville. But these jobs are vulnerable to economic downturns, production shifts, automation, and company decisions made in distant corporate offices. If your income came from manufacturing and your hours were cut or your position was eliminated, falling behind on your mortgage wasn’t irresponsibility—it was economic displacement beyond your control.

Healthcare workers are essential but often underpaid. CNAs, medical assistants, technicians, and support staff at the hospital and nursing homes earn $12-16 per hour in many cases. Even RNs, who make better money, often carry significant student loan debt from nursing school. The essential nature of healthcare work doesn’t translate to compensation that easily affords housing in an appreciating market.

The Small-City Premium and Problem

Cookeville offers something many people value: small-city life with big-city amenities (relatively speaking). You’re close to nature—lakes, Cumberland Plateau hiking, outdoor recreation. Crime is lower than in larger cities. Traffic is manageable. The pace of life is slower. People know their neighbors. It’s the Tennessee small-town experience that many people romanticize.

This quality of life creates demand. People are willing to pay a premium to live in Cookeville specifically because it offers these amenities. Nashville refugees aren’t just seeking affordable housing; they’re seeking a lifestyle change. This demand supports higher prices.

But the premium assumes you can afford to enjoy it. The quality of life doesn’t matter much when you’re working two jobs to cover your mortgage, when you’re stressed about money constantly, when you can’t afford to actually go to the lake or participate in community activities because you’re financially strapped. The Cookeville lifestyle comes at a cost that’s increasingly difficult for working-class and middle-class residents to sustain.

The I-40 Corridor Effect

Cookeville’s location on Interstate 40—the major east-west route through Tennessee—makes it accessible and visible. It’s a natural stopping point between Nashville and Knoxville. This visibility attracts businesses, travelers, and potential residents.

But it also makes Cookeville vulnerable to economic forces beyond its control. When Nashville’s economy booms, Cookeville feels upward pressure on housing costs. When the national economy struggles, Cookeville’s manufacturing base suffers. The city’s fortunes are tied to larger economic patterns that local residents have no ability to influence.

The Weight You’re Carrying

Let’s address what you’re actually experiencing emotionally and practically, because foreclosure in a small city has particular characteristics.

The Small-Town Visibility Problem

Cookeville is small enough that people know people. Not everyone knows everyone, but there’s significantly more interconnection than in a large city. Your coworkers might go to your church. Your kids’ teachers might be in your neighborhood. You see people you know at Walmart, at restaurants, around town.

When you’re facing foreclosure in this environment, the fear of exposure is heightened. Foreclosure notices are published in the local newspaper. Some people will see it. Word might spread. In larger cities, anonymity provides cover. In Cookeville, you’re more likely to encounter people who know about your situation.

The shame feels more acute. You’re not just a statistic in a faceless metro area. You’re a known person in a smaller community. The thought of people knowing, talking about it, pitying you or judging you—it’s suffocating.

The reality is that people are more focused on their own problems than on yours. Most people who see a foreclosure notice forget about it almost immediately. The ones who remember are often dealing with their own financial struggles that they’re hiding. The judgment you fear is largely imagined rather than real. But the fear is still real, and it adds to your burden.

The “We Moved Here to Escape Nashville” Irony

If you’re one of the people who moved to Cookeville from Nashville specifically because Nashville became unaffordable, there’s a particular irony and frustration to facing foreclosure here.

You made what seemed like a smart financial decision. You left an expensive city for an affordable one. You thought you were getting ahead, creating financial margin, making a wise choice for your family. The math made sense when you ran the numbers.

But the reality didn’t match the plan. Maybe the Cookeville job you found doesn’t pay as much as your Nashville job did. Maybe the lower housing cost was offset by commuting expenses or hidden costs you didn’t anticipate. Maybe Cookeville became less affordable faster than you expected. Maybe life happened—job loss, medical bills, divorce—and you no longer have the financial cushion you thought you’d created by moving here.

The sense of failure is compounded. You failed in Nashville (couldn’t afford it anymore). You failed in Cookeville (facing foreclosure in the supposedly affordable place). Where do you go from here? What does it say about you that you can’t make it work even in a small Tennessee city? These questions gnaw at you, even though they’re fundamentally unfair questions based on false premises about personal failure versus systemic economic dysfunction.

The Tennessee Tech Connection and Modest Salaries

If you work at Tennessee Tech—whether as faculty, staff, or in any of the support roles that keep a university functioning—you have a stable job with good benefits, but you’re not highly paid unless you’re in a senior administrative position or a tenured professor in a marketable discipline.

Academic and staff salaries are notoriously modest. An assistant professor might make $50,000-65,000. A staff member in student services or administration might make $35,000-45,000. These are respectable salaries in Cookeville’s context, but they’re not generous. They assume a cost of living that’s genuinely affordable.

When housing costs increase significantly, your salary doesn’t increase proportionally. You might get a 2-3% cost-of-living raise annually. That’s $1,000-1,500 on a $50,000 salary. If your property taxes increased by $800 this year and your homeowner’s insurance went up $400, your raise barely covered those increases, let alone general inflation in other areas.

You’re doing meaningful work in a good job, and you still can’t afford your mortgage. That’s not personal failure. That’s the mismatch between salary structures that assume affordable housing and housing markets that are no longer affordable on those salaries. The problem is structural, not personal, but it feels personal when you’re the one lying awake at 3 AM worrying about how to make next month’s payment.

The Healthcare Worker Exhaustion and Underpayment

Cookeville Regional Medical Center is a significant employer. Nursing homes, clinics, home health agencies—healthcare employs a substantial portion of Cookeville’s workforce. These are essential jobs. People’s lives literally depend on healthcare workers showing up and doing their jobs well.

And the compensation is inadequate for the demands of the work. CNAs are making $13-15 per hour to do physically demanding, emotionally exhausting work. That’s $27,000-31,000 per year. You cannot afford a house—even a modest house in Cookeville—on that income alone, and if your household depends on that income as either the primary or a significant secondary income, financial strain is almost inevitable.

RNs make better money—$55,000-70,000 typically—but many are burdened by student loan debt. A BSN degree costs $40,000-60,000 at many institutions. Monthly payments of $400-600 for ten years or more. When you combine student loan payments with a mortgage, car payment, insurance, and normal living expenses, even a decent nursing salary can be stretched to the breaking point.

The work itself is draining. Healthcare workers give everything to their patients, and then they come home to financial stress that never lets up. The combination of occupational stress and financial stress creates a level of exhaustion that affects every aspect of life. If you’re a healthcare worker facing foreclosure, you’re not failing. You’re being failed by a system that depends on your labor while refusing to compensate you adequately for it.

The Fixed-Income Retirement Squeeze

Cookeville attracts retirees—it’s affordable compared to larger Tennessee cities, it has a good regional medical center, it’s close to outdoor recreation, it has the amenities of a college town. Many retirees chose Cookeville deliberately for these reasons.

But living on Social Security and modest pensions becomes increasingly difficult as costs rise. Social Security might provide $1,500-2,000 per month. A small pension might add another $500-1,000. That sounds like enough until you list the actual expenses: mortgage or rent, property taxes, insurance, utilities, Medicare supplement, prescriptions, food, transportation, home maintenance.

Property taxes are particularly burdensome. Even though Cookeville’s property values are lower than Nashville’s, property taxes still represent a significant annual expense. If you’re on a fixed income and your property tax bill increased from $1,200 to $2,000 over several years because your home’s assessed value increased, that extra $800 per year ($67 per month) is meaningful when you’re on a tight budget.

One unexpected expense destroys the fragile balance. A $1,500 car repair. A $2,000 home repair. A $3,000 medical bill not covered by Medicare. You don’t have savings to absorb these shocks, so you miss a mortgage payment. Then another. Then you’re in default. Then you’re in pre-foreclosure. All because you’re trying to survive on an income designed for a cost of living that no longer exists.

The Commuter Exhaustion and Cost

If you’re commuting from Cookeville to Nashville for work—and some people do—the toll on your life is enormous even if the finances theoretically work.

The time cost is staggering. Ninety minutes each way is three hours daily, fifteen hours weekly, approximately 750 hours annually. That’s the equivalent of 94 eight-hour workdays, or nearly 19 work weeks, spent sitting in a car. Time you’re not with your family, not exercising, not pursuing interests, not living. Just driving.

The financial cost adds up quickly. At current gas prices and assuming a reasonably fuel-efficient vehicle, you’re spending $400-500 monthly on gas alone. Add vehicle maintenance (oil changes, tire wear, brake wear, general deterioration from high mileage), and you’re easily spending $600-700 monthly on commuting costs. That’s $7,200-8,400 annually. For many people, that’s the difference between making the mortgage payment and falling behind.

The physical and emotional toll is real. Three hours in a car every day is exhausting. It’s stressful. It affects your health, your relationships, your mental state. You’re chronically tired. You’re irritable. You don’t have energy for your family when you get home. The stress contributes to health problems, which create medical expenses, which create more financial pressure. It’s a vicious cycle.

If you moved to Cookeville thinking you could maintain a Nashville income while enjoying Cookeville’s lower cost of living, but the commute is destroying you and the costs are eating up your savings, you’re not weak or foolish. You made a reasonable choice based on incomplete information about how sustainable that arrangement would actually be.

How Foreclosure Works in Tennessee

The legal foreclosure process is uniform across Tennessee, but the practical experience varies by location. Here’s what you need to know about how it works in Cookeville and Putnam County.

The Tennessee Foreclosure Timeline

Months 1-3: Default and Initial Notices

When you miss your first payment, the lender sends notices. These initial communications are typically automated and relatively impersonal. You’ll receive letters, phone calls, and possibly emails reminding you of the missed payment and requesting that you bring your account current.

After approximately 90 days of non-payment, the tone changes. You’ll receive a formal Notice of Default, which is a legal document stating that you violate your mortgage agreement. This notice provides a deadline by which you must cure the default (pay what you owe plus late fees) or face foreclosure proceedings.

This period is critical because you still have maximum leverage. The lender genuinely prefers to work something out rather than foreclose. Foreclosure is expensive and time-consuming for them. They’d rather modify your loan, accept a repayment plan, or even approve a short sale than go through foreclosure. But you have to engage with them during this window.

Month 3-4: Notice of Sale

If you haven’t cured the default or worked out an arrangement, the lender will send a Notice of Sale. Tennessee law requires at least 20 days’ notice before a foreclosure sale can occur. This notice must include the date, time, and location of the sale, along with a legal description of your property.

The Notice of Sale must be sent to you by certified mail. It must also be published in a local newspaper—in Cookeville, this is typically the Herald-Citizen—once per week for three consecutive weeks before the sale date.

The publication requirement is what creates the visibility problem in a small city. Your foreclosure isn’t hidden. It’s public record. In Cookeville, where the newspaper still has readership and where social networks are tighter than in large cities, there’s a real possibility that people you know will see this notice.

The Sale Date: At the Putnam County Courthouse

On the scheduled date—typically a Tuesday morning—your property is auctioned on the steps of the Putnam County Courthouse on the square in downtown Cookeville. The auction is public. Anyone can attend. Anyone can bid.

The lender typically bids the amount you owe (the mortgage balance plus foreclosure costs). If no one bids higher, the lender takes ownership of the property. If someone bids higher—an investor, another buyer—they win the auction and take ownership.

This is the point of no return. Once the gavel falls, the property is sold. You no longer own it.

After the Sale: Vacating the Property

Once the foreclosure sale is complete, you must vacate the property. Tennessee doesn’t provide a significant redemption period in most foreclosure cases. You’ll receive notice to leave, and if you don’t leave voluntarily, the new owner can initiate eviction proceedings through the court.

Deficiency Judgments: The Hidden Danger

Tennessee allows deficiency judgments. If your property sells at foreclosure auction for less than you owe, the lender can sue you for the difference. In Cookeville’s market, where properties sometimes sit unsold and where auction prices are typically below market value, this is a real risk.

For example: You owe $180,000 on your mortgage. Your house sells at auction for $145,000. The lender can seek a deficiency judgment for the $35,000 difference (plus foreclosure costs). You lose your house and you still owe tens of thousands of dollars. It’s the worst possible outcome.

This is why avoiding foreclosure—by selling the property yourself before the auction—is almost always the better choice, even if you don’t get as much as you hoped for the property.

The Cookeville Market Reality

Properties in Cookeville don’t sell as quickly as in Nashville. Cookeville’s market is active but not frenzied. Houses typically sit on the market for 30-60 days or longer, depending on price, condition, and location. This slower pace is good for buyers but challenging for sellers who need to move quickly.

Foreclosure sales often result in below-market prices. Investors who bid at foreclosure auctions are looking for deals. They’re not paying retail. Your house that might sell for $200,000 in a traditional sale might sell for $160,000 at foreclosure auction. That $40,000 difference matters enormously to you.

Cookeville Neighborhoods: Location Affects Everything

Where your house is located in Cookeville dramatically affects your options, your timeline, and your likely outcomes.

Near Tennessee Tech Campus

Properties within walking or short driving distance of campus are affected by student rental demand. If your house is in this area, it might be appealing to investors who buy properties to rent to students. This can be an advantage—you have a buyer pool that traditional family buyers don’t represent.

However, student rentals come with challenges. Houses in these areas often show more wear from high-turnover renters. The neighborhood character might not appeal to families. Traditional buyers might avoid these areas, which limits your options if you’re trying to sell quickly.

West Cookeville / Newer Developments

The areas west of town, toward I-40, have seen the most recent residential development. Newer subdivisions, modern amenities, typically better schools (depending on specific zone). These are the areas where Nashville refugees and young professional families tend to buy.

If your house is in this area, you have the best market in Cookeville. These properties sell more reliably and more quickly than in other areas. You likely have equity unless you bought very recently. A traditional sale might be viable if you have time.

East Cookeville / Established Neighborhoods

East Cookeville contains many of the city’s established, older neighborhoods. These areas have character and mature trees, but the housing stock is older and often needs updates. Properties range from well-maintained to neglected, which creates variability in the market.

If your house is well-maintained, it can sell. If it needs significant work, you’ll struggle in a traditional sale because buyers in Cookeville are price-sensitive and have limited tolerance for major renovation projects. Selling to a cash buyer who purchases as-is might be your best option.

South Cookeville and County Areas

South of downtown and into the county, properties are more varied. Some rural acreage, some older subdivisions, some manufactured homes, some very nice properties with land. The market in these areas is thin—buyers are fewer, sales are slower.

If your property is in these areas, be realistic about timeline. A traditional sale could take months. If foreclosure is imminent, you don’t have months. Cash sale might be your only realistic option.

The Algood and Baxter Areas

Technically separate towns but part of the Cookeville area, Algood and Baxter have their own character and markets. Generally more affordable than Cookeville proper, but with a smaller buyer pool.

Properties in these areas can be challenging to sell quickly. The market is small. The buyer pool is limited. If you need to sell fast, traditional sale might not be realistic.

Your Real Options

Let’s discuss your actual options with honesty about what works and what doesn’t in Cookeville’s market.

Option 1: Catch Up on Payments Completely

If you suddenly have access to enough money to pay everything you owe and bring your account current—inheritance, bonus, family assistance, lottery winnings—then obviously, do that. Problem solved immediately.

For most people reading this, that option doesn’t exist. If you had that kind of money available, you wouldn’t be in pre-foreclosure. So let’s move on to realistic options.

Option 2: Loan Modification or Forbearance

You can contact your lender and request a loan modification. This might involve lowering your interest rate, extending the term of your loan (stretching payments over more years to reduce the monthly amount), or temporarily pausing or reducing payments through forbearance.

The process is bureaucratic and slow. You’ll submit extensive financial documentation. You’ll wait weeks or months for decisions. You’ll likely have to resubmit documents multiple times. You’ll speak with different representatives who give you different information. It’s frustrating and exhausting.

The outcome is uncertain. The lender is under no obligation to modify your loan. They might approve a modification. They might approve forbearance. They might deny your request entirely. You won’t know until you go through the entire process.

If you want to try this route, do it. Some people successfully negotiate modifications. But don’t wait months for an answer while the foreclosure clock runs. Pursue this option while simultaneously exploring other options. Don’t put all your hope in loan modification and then find yourself at a foreclosure auction because the bank said no.

Option 3: Traditional Sale with a Real Estate Agent

You can list your property with a local real estate agent, price it competitively, market it to potential buyers, wait for offers, negotiate, go through inspections and appraisals, and close in 30-60 days if everything goes smoothly.

This works if:

- You have equity in your property

- Your house is in decent condition or you have money to make it presentable

- You have 60-90 days minimum before foreclosure (realistically longer in Cookeville)

- You can emotionally handle the process of showings, negotiations, and uncertainty

- Your property is in a desirable area with good buyer demand

This doesn’t work if:

- You’re underwater (owe more than the property is worth)

- You’re weeks away from foreclosure

- Your house needs significant repairs you can’t afford to make

- You’re emotionally exhausted and can’t handle the traditional sale process

- Your property is in an area with limited buyer interest

The costs of traditional sale include:

- Real estate agent commission: 5-6% of sale price (on a $200,000 house, that’s $10,000-12,000)

- Closing costs: typically 2-3% of sale price

- Repairs that buyers require during inspection

- Carrying costs while the property is listed (you continue paying mortgage, insurance, utilities)

- Time and emotional energy

If you’re in a good area with time and a decent house, traditional sale is worth considering. Your agent can pull comparable sales and give you realistic expectations about price and timeline. But if you don’t have time or your property is challenging, traditional sale probably won’t work.

Option 4: Short Sale

If you owe more than your house is worth, a short sale might be necessary. This is where your lender agrees to accept less than the full mortgage payoff amount. The bank takes a loss, but it’s better for them than foreclosure (which costs them money and time), and it’s better for you than foreclosure (less damage to your credit).

Short sales are complex and slow. You need to find a buyer willing to wait (often months) for bank approval. You need to submit a complete financial hardship package to your lender. You need to wait for the lender’s loss mitigation department to review and approve the sale. The process typically takes 2-4 months minimum, sometimes much longer.

We can help with short sales. We’ve successfully negotiated short sales with lenders. We understand what documentation they need, how to present your hardship case, and how to navigate the approval process. If you’re underwater, a short sale might be your best option, and we have the experience to make it work.

Option 5: Sell Directly to Us for Cash

This is where we provide a solution specifically designed for situations like yours—when time is short, when the property needs work, when traditional options won’t work for whatever reason.

How it actually works:

- You contact us (phone call or online form)

- We have a real conversation about your situation—what’s happening, what you owe, what condition the property is in, what your timeline looks like, what matters most to you

- We come see your property (or conduct a virtual tour if you prefer or if you’ve already moved)

- We make you a written cash offer within 24-48 hours

- You take whatever time you need to decide (no pressure, no manipulation, no artificial urgency)

- If you accept, we handle everything (we work with the title company, we manage all the paperwork, we coordinate the closing)

- We close on your timeline (7-10 days if you need speed, or longer if you need time to make arrangements)

What you get with this option:

- Certainty: no deal falling through at the last minute

- Speed: we can close as fast as you need us to

- Simplicity: we handle all the complexity

- No repairs required: we buy as-is, whatever condition

- No commissions: we pay all closing costs

- No showings: one visit from us, no parade of strangers through your house

- Privacy: discreet transaction without extensive marketing

- Relief: the stress ends, the uncertainty ends, you can move forward with your life

What’s the trade-off? Our offer will be lower than theoretical maximum market value because we have to account for:

- Repairs and updates the property needs

- Holding costs while we prepare it for resale or rental

- Market risk and uncertainty

- Our time and expertise

- Our need to make a profit on the transaction (we’re running a business, not a charity)

But consider this context: That “maximum market value” assumes a perfect buyer appears quickly, pays top dollar, doesn’t negotiate hard after inspection, closes smoothly without issues. In Cookeville’s market, that’s not guaranteed. It might happen. It might not. It might take months to find out.

Traditional sale costs (6% commission, 2-3% closing costs, repairs) mean you’re netting maybe 8-9% less than sale price anyway. On a $200,000 house, that’s $16,000-18,000 in costs. Our offer might be 10-15% below retail, but you’re saving the commission and closing costs, and you’re getting certainty and speed.

For many people in your situation, the certainty and speed are worth more than the theoretical possibility of getting a bit more money through a traditional sale that might not even happen.

Real Stories from Cookeville Homeowners

These are actual situations we’ve encountered working with homeowners in Putnam County:

“I worked at one of the manufacturing plants. They cut our hours from 40 to 30, then laid off half the shift. I found another job, but it pays $5 less per hour. We couldn’t make the mortgage anymore. You bought our house quickly so we could move into something we can actually afford on my current income.”

“We moved from Nashville to escape the cost of living. I kept my Nashville job and commuted for two years. The commute nearly killed me—literally fell asleep at the wheel twice. Had to quit and find local work, but local jobs pay 30% less. Your offer let us sell before foreclosure and move to an apartment while we figure out our next step.”

“I’m a nurse at Cookeville Regional. Between my student loans and the mortgage, I was stretched too thin. One car repair that cost $3,000, and I fell behind on everything. You bought the house as-is even though it needed work, and I could eliminate the mortgage payment and just focus on getting my finances stable.”

“Retired and living on Social Security. Property taxes doubled over eight years. Income didn’t double. I was choosing between mortgage and medications. Selling to you let me move into senior housing I can afford, and now I can actually afford my prescriptions.”

“Inherited my parents’ house. Still had mortgage on it. I live in Knoxville and couldn’t manage two properties. Listed it with an agent—sat on market for four months with no offers. You bought it in two weeks and I could finally close that chapter of stress.”

“Divorce. Neither of us could afford the house alone, and we both just wanted it over with. You made an offer we could both accept, we split the proceeds, and we could both move on with our lives without the ongoing drama of trying to sell it traditionally while hating each other.”

“House needed major foundation work, new roof, HVAC replacement—easily $40,000 in repairs. On disability income with no savings. Your as-is purchase was literally my only option.”

Different circumstances. Different challenges. Same outcome: resolution instead of ongoing crisis.

What Cookeville Actually Is

Understanding what this city represents might help you process whatever decision you make about your house.

The History and Foundation

Cookeville was founded in 1854 and named after Richard Cooke, a local figure. It became the Putnam County seat and grew as a railroad town. Tennessee Polytechnic Institute (which became Tennessee Tech University) was established in 1915, providing educational opportunity and economic stability.

For most of its history, Cookeville was a quiet regional center—serving the surrounding rural counties, providing shopping and services, anchored by the university. It was never wealthy, but it was stable. It was the kind of place where families stayed for generations, where people knew each other, where life moved at a slower pace than in cities.

What It Is Now

Today, Cookeville has approximately 35,000 residents (with about 80,000 in the greater metro area including surrounding communities). It’s evolved significantly:

Positive developments:

- Tennessee Tech has around 10,000 students

- Municipal fiber broadband (Cookeville EPB) is providing gigabit internet

- Growing appeal to remote workers and Nashville refugees

- Improved retail and restaurant options

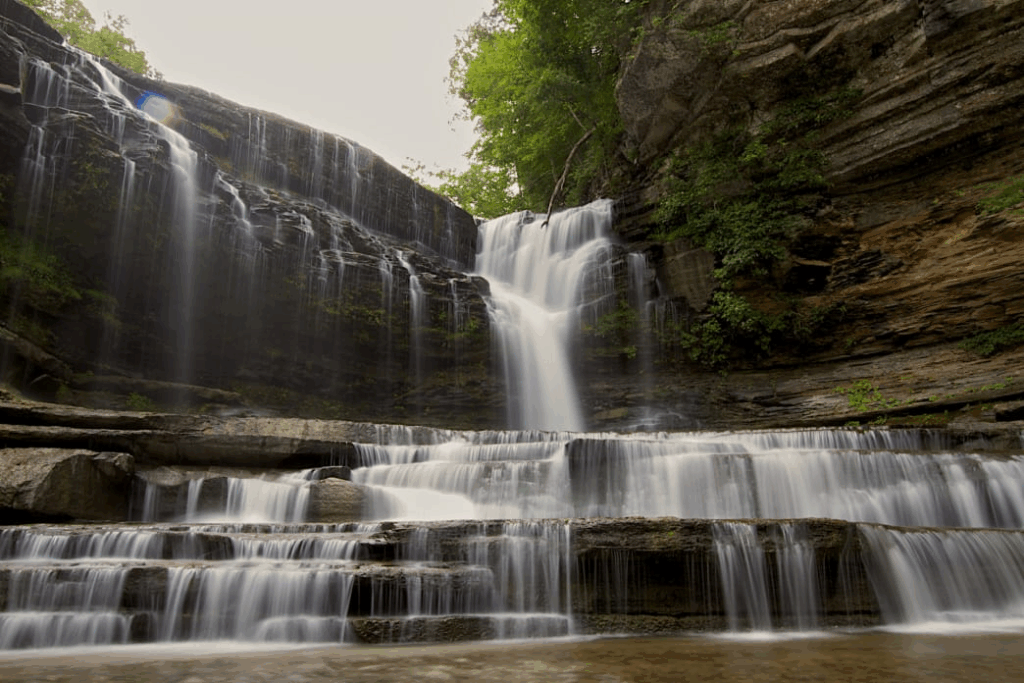

- Proximity to natural attractions (waterfalls, lakes, hiking)

- Lower crime than larger Tennessee cities

- Genuine small-city quality of life

Ongoing challenges:

- Manufacturing sector vulnerability

- Relatively low median household income

- Limited high-wage employment options

- Brain drain (college graduates leaving)

- Housing costs rising faster than local wages

- Limited public transportation

- Healthcare access issues in surrounding rural counties

Cookeville is at a crossroads. It’s growing and changing, becoming less isolated and more connected to larger economic forces. This brings opportunities but also challenges, including housing affordability pressures that affect longtime residents who aren’t benefiting from the growth.

The Upper Cumberland Context

Cookeville is the largest city in the Upper Cumberland region—a 14-county area of largely rural Tennessee. This means Cookeville serves as a regional hub for healthcare, shopping, education, and services.

This role provides economic stability (people from surrounding counties come to Cookeville to spend money), but it also means Cookeville’s fortunes are tied to the rural economy. When farming struggles, when coal mining continues its decline, when manufacturing plants close in small towns—Cookeville feels the ripple effects.

What You Need to Do Right Now

Stop reading and start acting. Here’s your next step:

Contact Us

- Where your house is located in Cookeville

- What condition it’s in (be honest—we’ve seen everything)

- Approximately what you owe versus what you think it’s worth

- Your timeline until foreclosure

- What matters most to you in resolving this situation

What Happens After You Contact Us

Within hours: We respond to your inquiry and schedule a time to talk or visit.

Within 24-48 hours of seeing your property: We provide a written cash offer with clear terms.

You take whatever time you need: Think about it, discuss it with family, compare it to other options, pray about it if that’s part of your process.

If you accept: We handle everything from that point forward. You show up at closing, sign the papers, hand over the keys, and walk away from this situation.

If you don’t accept: That’s fine. No hard feelings. No pressure. We’re here if circumstances change or if other options don’t work out.

The Only Wrong Decision Is No Decision

Taking no action guarantees the worst outcome. Foreclosure will happen. Your credit will be destroyed. You might face a deficiency judgment. You’ll lose any equity you have. You’ll be forced to move anyway, but without any control over timing or circumstances.

Any action—even imperfect action—is better than paralysis.

You’re Going to Be Okay

This is hard to believe when you’re in the middle of it, but it’s true: You’re going to be okay.

Losing this house doesn’t define you. It doesn’t mean you failed. It doesn’t mean you’re irresponsible or weak or bad with money. It means you encountered circumstances—economic, personal, medical, whatever combination of factors—that made keeping this particular house unsustainable.

People recover from foreclosure. Credit scores rebuild over time. Financial situations stabilize. People find new places to live that work better for their current circumstances. Life continues and often improves after the crisis ends.

Maybe you’ll stay in Cookeville in more affordable housing—renting for a while, or buying a smaller house later when you’re on firmer footing. Maybe you’ll move to Nashville or Knoxville where job opportunities are different. Maybe you’ll move to a smaller Tennessee town where costs are lower. Maybe you’ll move closer to family for support.

Whatever comes next, it starts with addressing this situation honestly and taking action to resolve it on the best terms available to you.

We’re here to help if you want our help. No judgment. No pressure. No manipulation. Just a possible solution to an impossible problem.

Frequently Asked Questions

Will this affect my job at Tennessee Tech?

No, foreclosure generally doesn’t affect employment unless your position specifically requires financial clearance, which most university positions don’t. Your employer won’t be notified about your foreclosure. Your job security shouldn’t be impacted. The bigger concern is usually the emotional and mental toll that financial stress takes on your work performance, which is why resolving the situation is important for your overall wellbeing.

What if I’m a remote worker who moved here from Nashville—should I just move back?

This is a personal decision that depends on multiple factors. Moving back to Nashville means higher housing costs (rent or purchase), but it eliminates commuting if you eventually return to office work, and it might provide more job opportunities if your remote situation changes. However, you’ll face the same housing affordability issues that caused you to leave Nashville initially. Consider whether the problem is Cookeville specifically or whether it’s about finding housing you can afford anywhere. Sometimes the solution is downsizing or renting rather than relocating to a more expensive city.

How quickly can you really close? Cookeville’s market is slow.

We can close as quickly as title work allows—typically 7-10 days if you need urgent closing, or we can accommodate longer timelines if you need a few weeks to arrange your next housing situation. The difference between us and traditional buyers is that we purchase with cash. We’re not waiting for mortgage approval, appraisals, or loan processing. We’re not going to back out at the last minute because our financing fell through. Once we give you a written offer and you accept it, we move directly to closing. In Cookeville’s slower market where traditional sales can take 60-90 days or longer, our speed is particularly valuable.

What if my house needs significant repairs?

We buy houses as-is in whatever condition they’re in. If your house needs a new roof, if the HVAC system is failing, if there are foundation issues, if the kitchen is from 1975 and hasn’t been updated, if there’s water damage or mold, if the carpet is ruined—none of that matters to us. We’ll assess the condition, we’ll factor repair costs into our offer, and we’ll buy it as it sits. You don’t have to fix anything. You don’t have to clean anything. You don’t have to make it presentable for showings. Traditional buyers in Cookeville want move-in ready houses or at least houses that don’t need major work. We’re not traditional buyers. We buy problem properties all the time.

Will people in Cookeville find out about my foreclosure?

Foreclosure notices are public record and are published in the Herald-Citizen as required by Tennessee law. Some people might see it. But Cookeville, while smaller than Nashville or Memphis, is still large enough that most people aren’t closely reading foreclosure notices in the newspaper. The vast majority of people you know will never know about your foreclosure unless you tell them. The fear of exposure is usually worse than the reality. That said, if you sell before the foreclosure auction (which is what we’re helping you do), there’s no foreclosure notice published, and the transaction remains private.

What if I’m underwater—I owe more than the house is worth?

This can happen if you bought recently with minimal down payment, if you refinanced and took cash out, or if the property value has declined or hasn’t appreciated as expected. If you owe more than your house is worth, we can help you with a short sale. We’ll work with your lender to negotiate an agreement where they accept less than the full payoff amount. We have experience with short sales and know how to present your case to the lender’s loss mitigation department. The process takes longer than a regular sale (typically 2-4 months), but it allows you to avoid foreclosure even when you’re underwater. The impact on your credit is less severe than foreclosure, and you don’t risk a deficiency judgment.

I’m embarrassed about this situation. Will you judge me?

No. We’ve worked with hundreds of homeowners in foreclosure situations. We’ve seen every circumstance imaginable—job loss, medical debt, divorce, business failures, unexpected expenses, economic displacement, you name it. We understand that foreclosure happens to good, responsible people who encounter circumstances beyond their control. There’s no judgment from us. This is a business transaction where we’re providing a service (buying your house quickly for cash) that solves a problem you’re facing. The circumstances that led you here are your private business. We’re not here to judge your choices or your situation. We’re here to help you resolve it if you want our help.

What happens if I do nothing and let the foreclosure happen?

If you take no action, the foreclosure process will continue on its timeline. Your house will be auctioned at the Putnam County Courthouse. The highest bidder will take ownership. You’ll be required to vacate the property. The foreclosure will remain on your credit report for seven years and will significantly damage your credit score. If the auction price is less than what you owe (which often happens), your lender can pursue a deficiency judgment, meaning you’ll lose your house and still owe money. You’ll have very limited housing options afterward because your damaged credit will make it difficult to rent a decent apartment or qualify for another mortgage. This is the worst possible outcome. Even if selling means getting less than you hoped for your property, it’s almost always better than letting foreclosure happen.

Can I rent out my house instead of selling?

Theoretically yes, but practically this is often not a good solution when you’re already in financial distress. To rent successfully, you need: (1) enough rental income to cover mortgage, taxes, insurance, maintenance, and vacancy periods, (2) cash reserves for repairs and unexpected expenses, (3) ability to handle tenant issues, evictions if necessary, and property management, and (4) emotional bandwidth to be a landlord while also dealing with financial stress. Most people facing foreclosure don’t have adequate cash reserves, and the stress of being a landlord often makes the situation worse rather than better. The Cookeville rental market is competitive due to student demand, and being a landlord is harder than people expect. Unless you have significant cash reserves and property management experience, selling is usually a better option than attempting to become a landlord while in financial crisis.

What if I have sentimental attachment to this house?

That’s completely understandable. This isn’t just a building; it’s where you’ve lived your life. Maybe your kids grew up here. Maybe you have memories here. Maybe you put your own work into the house—renovations, landscaping, decorating. Letting go of those memories is genuinely difficult. But here’s what we’ve observed: the house is a container for the memories, but the memories themselves aren’t tied to the physical structure. You carry those memories with you regardless of where you live. Your children’s childhoods don’t disappear when you move. The love and life that happened here doesn’t evaporate. Sometimes letting go of the physical house is the right choice even though it’s emotionally painful. You can honor the memories while still making the practical decision to move forward. The grief is real and valid, and you should allow yourself to feel it. But don’t let sentimental attachment trap you in a financially destructive situation.

How do I explain this to my kids?

Age-appropriate honesty is usually the best approach. For younger children (elementary age): “We’re going to move to a different house that works better for our family right now.” Keep it simple and focus on continuity—you’ll still be a family, they’ll still have their stuff, they’ll still go to school (or explain the school change matter-of-factly). For middle schoolers: “We’re having some money problems with this house and we need to move somewhere more affordable. This isn’t your fault and it doesn’t mean anything bad about our family.” For teenagers: They can handle more truth. “We’re behind on our mortgage and we’re selling the house so we don’t lose it to foreclosure. This is stressful and I’m not happy about it, but we’re going to be okay.” What kids need to hear most: This isn’t their fault, the family is staying together, the adults are handling the problem, they’re safe and loved regardless of what house they live in.

Take Action Now

You’ve read this entire page. You understand your situation and your options. You know what we offer and how it might help you.

The only remaining question is: Are you ready to take action?

Pick up the phone. Fill out the form. Start the conversation.

You’re going to be okay. It starts with this next step.

Titan Property Investors

Your trusted partner in real estate

Address

731 S. 7th St.

Heber Springs, AR 72543

Phone

Send us a message

We’d love to hear from you. Fill out the form below.