Pre-Foreclosure Help in Chattanooga, Tennessee

The Scenic City Shouldn’t Cost You Everything

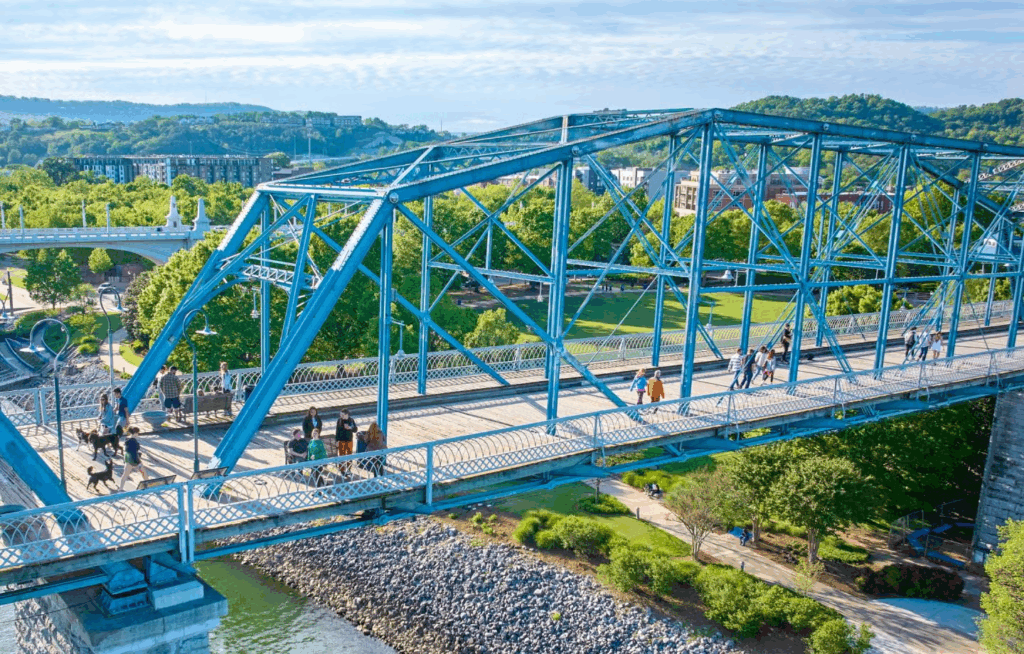

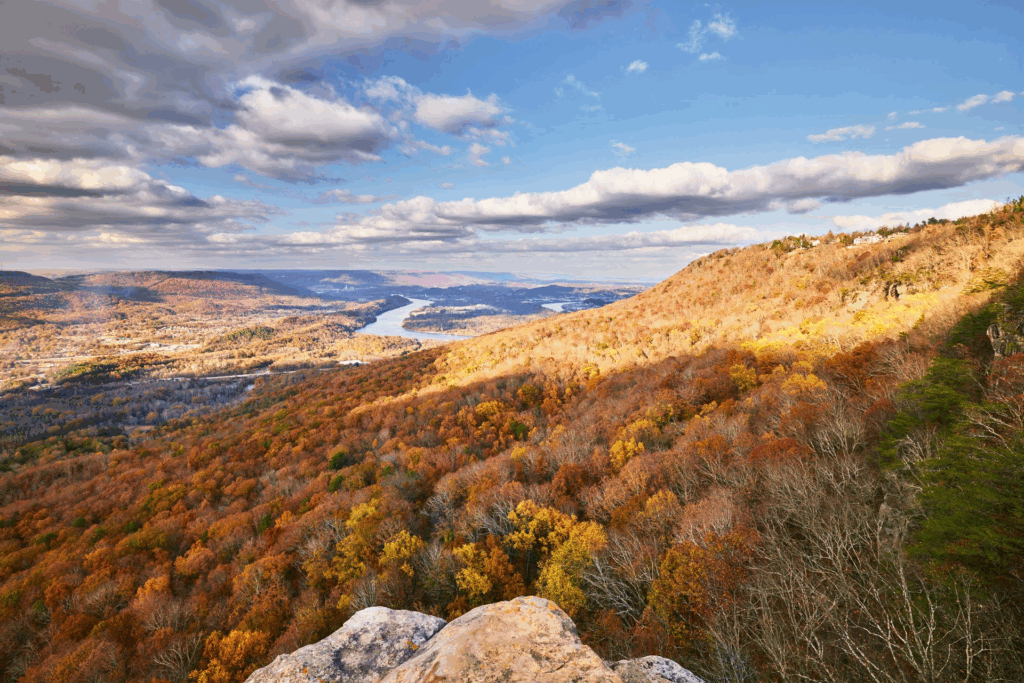

They call it the Scenic City, and they’re not wrong. You wake up every morning and see Lookout Mountain rising above the city. You cross the Walnut Street Bridge—one of the longest pedestrian bridges in the world—and watch the Tennessee River flow beneath your feet. You drive through the tunnels carved into Missionary Ridge. You walk along the Riverwalk and feel like you’re in a postcard.

But right now, the scenery doesn’t matter much when you’re three months behind on your mortgage.

This is the paradox of Chattanooga in 2026. It’s been on every “best places to live” list for a decade. Outside Magazine called it one of the best outdoor cities in America. The New York Times wrote glowing articles about its comeback story—from declining industrial city to tech hub with the fastest internet in the country. People are moving here from all over—Atlanta, Nashville, even California and Colorado—bringing their remote work jobs and their higher salaries and their willingness to pay prices that would have been unthinkable ten years ago.

And you? You’re here reading about pre-foreclosure because the city you love, the city you maybe grew up in or chose to make your home, has become something you can’t afford anymore.

Maybe you’re one of the longtime Chattanoogans who watched this transformation happen. You remember when downtown was empty, when nobody wanted to live there, when the north shore was industrial wasteland. You remember when you could buy a house in St. Elmo or Highland Park or the Southside for nothing. You watched the Volkswagen plant open and thought it would mean good jobs for everyone. You watched the gigabit internet launch and thought Chattanooga was finally getting its due.

You didn’t realize it would mean you’d be priced out of your own city.

Or maybe you moved here because it looked affordable compared to where you were coming from. You saw the outdoor recreation, the mountains, the river, the breweries, the food scene, and the fiber internet. You thought you could build a life here. And you did, for a while. Until the math stopped working.

Here’s what we need you to understand before anything else: This isn’t your fault, and you still have options.

The fact that you’re struggling doesn’t mean you failed. It means you’re trying to survive in a city where the median home price has increased 60% in five years while wages haven’t kept pace. It means you’re dealing with an economy that increasingly doesn’t work for regular working people, even in cities that are supposedly “thriving.”

And pre-foreclosure, scary as it sounds, isn’t the end. It’s a status. A warning. A window of time where you still have control, where you can still make decisions, where you can still walk away on your terms instead of the bank’s terms.

Let’s talk about what that actually means.

How Foreclosure Works in Tennessee

Tennessee foreclosure law is the same whether you’re in Memphis, Nashville, Knoxville, or Chattanooga. But the experience of going through it feels different depending on where you are. In Chattanooga, a city of about 185,000 people that sometimes feels like a small town despite being a metro area, the public nature of foreclosure hits differently.

Here’s the process, in plain language:

The Timeline From First Missed Payment to Losing Your House

Months 1-3: The Grace Period (Sort Of)

You missed a payment. Then another. The bank sends letters. They call. They’re annoying but not aggressive yet. This is the period where most people panic and freeze—stop opening mail, stop answering calls, hope it goes away somehow.

It doesn’t go away.

But this is also your best window to act. The bank would actually prefer to work something out with you. Foreclosure costs them money, time, and hassle. If you can catch up, great. If you can negotiate a modification, even better. If you can sell the house yourself, that works for them too.

Month 3-4: The Official Notices Start

Once you’re 90-120 days behind, they send the formal Notice of Default. This is the “we’re getting serious” communication. Tennessee law requires them to give you written notice that you’re in default and that they intend to foreclose if you don’t cure the default.

Shortly after—at least 20 days before any sale—they send the Notice of Sale. This tells you exactly when and where your house will be auctioned if you don’t stop the process.

The Public Part: Newspaper Publication

Here’s where it gets uncomfortable in a city like Chattanooga. The lender has to publish notice of the foreclosure sale in a local newspaper—the Chattanooga Times Free Press, typically—once a week for three consecutive weeks.

In a bigger city, this might feel anonymous. In Chattanooga, where neighborhoods are close-knit and people know people, it can feel exposing. Not everyone reads the newspaper, true. But some people do. And foreclosure notices are public record.

The Sale: Hamilton County Courthouse

If you haven’t stopped the process by selling, paying, or negotiating, your house goes to auction. Usually at the Hamilton County Courthouse downtown, sometimes on the courthouse steps, sometimes inside. Tuesday mornings are common. It’s public. Anyone can bid. Usually the bank bids the amount you owe. Sometimes an investor outbids them.

Highest bidder wins. You lose the house.

After: Limited Time to Leave

Tennessee has limited redemption rights, and they often don’t apply in non-judicial foreclosures. Once the sale happens, you typically have to leave quickly. If you don’t leave voluntarily, the new owner can evict you.

But Here’s the Critical Thing

At any point before that auction gavel comes down, you can stop this. You can sell the house yourself. You can negotiate a short sale if you’re underwater. You can work out a deal with the lender. You can choose how this ends instead of having it chosen for you.

The key is acting while you still have time. Not waiting until the week before the auction. Not hoping a miracle will save you at the last second. Acting now, while you have options.

What Your Chattanooga Home Actually Means

Let’s get specific about where you are and what you’re potentially losing, because “a house in Chattanooga” means very different things depending on the neighborhood.

If You’re Downtown or Northshore

You’re in the heart of the transformation. Maybe you have a loft in one of the renovated buildings downtown—Warehouse Row, the old terminal building, one of the new developments. Or you’re on the Northshore—Frazier Avenue with its restaurants and shops, or one of the residential streets where old houses have been renovated into expensive homes, or one of the new condo buildings.

You’re within walking distance of the Riverwalk, the aquarium, the restaurants, the breweries. You can walk across the Walnut Street Bridge to work or just for exercise. You’re in the thick of what makes Chattanooga Chattanooga right now—the urban renaissance, the outdoor culture, the sense that this city is on the rise.

You probably paid a lot for this location. Or you bought early and watched your property value skyrocket and your property taxes with it. Either way, you’re in a desirable area, which means your house has value even if you’re behind on payments.

If You’re in St. Elmo

You’re at the base of Lookout Mountain, in one of Chattanooga’s oldest neighborhoods. Maybe you have one of the historic bungalows on a street with massive trees. Maybe you’re in one of the newly renovated places. St. Elmo has gentrified hard over the last decade—what used to be an affordable working-class neighborhood is now expensive and trendy.

You’re walking distance to the Incline Railway, to the Barking Legs Theatre, to Main Street Meats and the other restaurants that have opened. You’re where tourists go to access Lookout Mountain. You’re in a neighborhood that’s been discovered, which is great for property values but terrible for affordability.

If You’re in Highland Park, Riverview, or Alton Park

You’re in the neighborhoods that haven’t gentrified yet, or are just starting to. Working-class neighborhoods, historically Black neighborhoods in some cases, where families have lived for generations. Where the houses are more modest, where the prices are lower, where you could actually afford to buy.

But you’re also in neighborhoods that are next in line for gentrification—everyone knows it, you can feel it happening. The developers are starting to look at Highland Park. Riverview is being talked about as “up and coming.” Which means your property taxes are starting to climb even though your income isn’t.

If You’re in Red Bank, East Ridge, or the Suburbs

You’re outside the city proper, in the communities that surround Chattanooga. Red Bank to the north, East Ridge to the east, technically their own cities but part of the metro. Maybe you’re out in Hixson or Middle Valley or Soddy-Daisy or Ooltewah.

You bought out here because it was cheaper. More space, better schools (maybe), lower prices. But the commute into Chattanooga for work is eating you alive—gas, car maintenance, time. And the areas are growing, developing, and getting more expensive. You’re not escaping the cost increases by being in the suburbs anymore.

If You’re in East Brainerd, East Ridge, or Harrison

You’re in the suburban sprawl, where chain restaurants line the highways and subdivisions spread across what used to be farmland. Where Walmart and Target and every franchise you’ve ever heard of have locations. Where the schools are decent and the houses are newer and everything requires driving.

You probably thought you were making the safe choice. Suburban stability. Good for raising kids. Away from urban problems. But the costs of suburban life add up—two cars minimum, driving everywhere, HOA fees maybe, property taxes that keep climbing.

If You’re Near the University or Southside

You’re near UTC—the University of Tennessee at Chattanooga—in neighborhoods that mix students and longtime residents. Or you’re in the Southside, one of the rapidly gentrifying areas, where old industrial buildings are becoming lofts and new restaurants are opening and the character is changing fast.

You might own a house you bought before the transformation, watching your neighborhood become expensive around you. Or you bought into the transformation and now you’re struggling to keep up with the costs.

The Point Is This:

Wherever you are in Hamilton County, your house has been part of your life. It’s where you’ve lived your actual days—made breakfast, slept, fought with your spouse, raised kids, had friends over, celebrated holidays, grieved losses. It’s been the physical container for your life.

And it has value. Chattanooga’s market is strong. The city is still growing. People want to live here. That means even if you’re behind on payments, even if you think you’re underwater, even if you’re scared about what comes next, there are likely options you haven’t considered.

The Specific Weight of Losing Your Home in a “Best Place to Live”

There’s a particular cruelty to struggling financially in a city that’s constantly being celebrated for how great it is.

You see the articles about Chattanooga’s comeback. The tech startups. The gigabit internet. The outdoor recreation. The rankings on every “best cities” list. The celebrities are buying houses here. The companies are relocating employees here. The entrepreneurs are opening businesses. The venture capital is flowing in.

And you’re about to lose your house.

You drive through downtown and see the construction cranes, the new buildings going up, the renovated warehouses, the expensive restaurants. You see people at the outdoor cafes, people shopping at the boutiques, people who seem to have disposable income to spend on thirty-dollar entrees and craft cocktails.

And you’re rationing groceries to try to scrape together mortgage payments.

You read about how Chattanooga created jobs with the VW plant, how unemployment is low, and how the economy is strong. You hear about people moving here from expensive cities and saying how affordable it is.

And you’re working forty-plus hours a week and can’t make ends meet.

There’s a disconnect. A cognitive dissonance. The story being told about Chattanooga—thriving, growing, successful, transformed—doesn’t match your lived experience of struggling to survive here.

It makes you feel isolated. Like you’re the only one who can’t make it work in a city where supposedly everyone else is thriving. Like there’s something wrong with you specifically.

But here’s the truth that doesn’t make it into the glossy magazine articles about Chattanooga’s renaissance: The transformation has left a lot of people behind. The rising costs have priced out longtime residents. The good jobs aren’t as plentiful as the headlines suggest. The inequality is real and growing.

You’re not alone in struggling here. You’re just alone in talking about it, because everyone else is also pretending they’re fine, also trying to maintain the appearance of success, also scared to admit they’re drowning.

The poverty rate in Chattanooga is higher than the national average. About 17% of people here live below the poverty line. That’s one in six people. But you don’t see them in the articles about how great the city is. You don’t hear their stories when journalists come to write about Chattanooga’s tech boom and outdoor culture.

The median household income in Chattanooga is about $52,000. That’s below the national median. But the housing prices have been climbing faster than incomes. The cost of living has been increasing. The gap between what people earn and what it costs to live here has been widening.

So no, you’re not failing. You’re not uniquely bad with money. You’re not the only one struggling. You’re just the one who’s honest enough to admit you need help, brave enough to look for solutions, smart enough to recognize that pretending everything’s fine won’t make it fine.

Why People in Chattanooga End Up Here

Let’s talk about the actual reasons people end up in pre-foreclosure in this city, because understanding you’re not alone might help.

The VW Layoffs and Supply Chain Issues

Volkswagen opened its plant in 2011, was supposed to be the economic engine that would sustain the city. At its peak, it employed thousands of people directly and created thousands more jobs in the supply chain. But the automotive industry is volatile. There have been production slowdowns, temporary layoffs, shifts in what they’re manufacturing. If you were counting on VW employment to be stable, and it wasn’t, and you lost your job or your hours got cut, suddenly that affordable mortgage isn’t affordable anymore.

Healthcare Worker Burnout and Turnover

Chattanooga has major hospital systems—Erlanger, CHI Memorial, Parkridge. Healthcare is a huge employer. But healthcare workers—nurses, techs, support staff—are burning out. The pandemic accelerated it, but it’s been building for years. High stress, mandatory overtime, emotional exhaustion, and wages that haven’t kept pace with the responsibility. People are leaving healthcare, taking lower-paying but less stressful jobs, and discovering they can’t make the same mortgage payments on their new salary.

The Service Industry Doesn’t Pay Enough

Chattanooga’s economy is heavily weighted toward tourism and hospitality. Restaurants, breweries, hotels, the aquarium, Rock City, Ruby Falls, the Incline Railway. These are huge employers. But service industry jobs don’t pay enough to afford housing in a city where prices are climbing. If you work at a restaurant or hotel, even if you’re full-time, even if you work hard, you’re probably making $30,000-$40,000 a year. That’s barely enough to survive, let alone thrive.

Remote Workers Drove Up Prices

The pandemic brought an influx of remote workers from expensive cities. They could work from anywhere, they chose Chattanooga for the outdoors and the fiber internet and the lower cost compared to where they came from. They brought salaries from San Francisco and New York and paid Chattanooga prices, which seemed cheap to them. But that drove up demand and prices for everyone else. Local workers earning local wages suddenly couldn’t compete for housing.

Property Taxes Increased as Values Skyrocketed

Even if your mortgage payment stayed the same, your property taxes probably didn’t. As home values increased—which sounds like good news—tax assessments increased too. If you’re on a fixed income or your wages haven’t increased proportionally, suddenly you’re paying hundreds or thousands more per year in property taxes on the same house.

Medical Debt

This is America. Medical debt destroys people financially regardless of where they live. Even with insurance, a serious illness or injury can generate tens of thousands in out-of-pocket costs. Medical debt is the leading cause of bankruptcy. It’s probably the leading cause of foreclosure too, even if people don’t always say it.

Divorce

Going from two incomes to one income while trying to maintain the same mortgage is impossible math. Even if the split was amicable, even if you’re both trying to do the right thing, the finances often don’t work. One person usually has to sell the house or face foreclosure.

The Gig Economy Doesn’t Replace Real Jobs

A lot of people piece together income from multiple gig jobs—DoorDash, Uber, TaskRabbit, and freelance work. It looks like you’re employed. You’re working constantly. But the income is unpredictable, there are no benefits, and you’re one car repair away from financial catastrophe.

Student Loan Payments Resumed

If you went to college—UTC, Covenant, maybe one of the community colleges, maybe somewhere else—you probably have student loans. After years of payment pause during the pandemic, payments resumed. For some people, that was several hundred dollars a month that suddenly came back into their budget, money that used to go toward the mortgage.

Unexpected Expenses

A roof that starts leaking. An HVAC system that dies in the middle of summer. A car that breaks down and costs $3,000 to fix. Your kid needs braces. Your dog gets sick and the vet bills add up. Life happens, and when you’re already living paycheck to paycheck, there’s no buffer for the unexpected.

Whatever combination brought you here, you’re here now. And the question isn’t “how did this happen” anymore. The question is “what do we do about it?”

What Actually Happens If You Do Nothing

Let’s be brutally honest about this, because sugar-coating it doesn’t help you make good decisions.

If you do nothing—if you keep avoiding the mail and the calls, if you keep hoping something will change, if you freeze up and wait—here’s what happens:

The Process Continues on Its Timeline

The bank doesn’t forget. The foreclosure doesn’t pause because you’re ignoring it. Every day that passes is a day closer to the auction. Every missed payment makes it harder to catch up. Every week you wait is a week less you have to explore your options.

Your Home Gets Auctioned at the Hamilton County Courthouse

On a Tuesday morning, probably. On the courthouse steps or in a room inside. Your address gets called out. Bidders raise their hands or call out numbers. The bank bids the amount you owe. Maybe an investor bids higher. Maybe not. Either way, the highest bid wins.

The house that you’ve lived in, that holds your memories, that’s been your home, gets sold to whoever bids the most money. You don’t get a say. You’re not even required to be there, and most people aren’t because it’s too painful to watch.

You Might Still Owe Money After Losing Your House

This is what people don’t realize. Tennessee allows deficiency judgments. If your house sells at auction for less than you owe on the mortgage—which often happens—the bank can sue you for the difference.

So you lose your house AND you still owe thousands of dollars. You’re homeless and in debt. It’s the worst possible outcome.

Your Credit Score Gets Destroyed

A foreclosure stays on your credit report for seven years. It drops your score by 200-300 points or more. Which means:

- You can’t qualify for another mortgage

- You’ll struggle to rent a decent apartment (landlords check credit)

- You’ll pay higher interest rates on car loans, credit cards, and everything

- You might have trouble getting certain jobs (some employers check credit)

- You’ll feel the impact for years

You Have to Leave

After the sale, you have to move out. Tennessee doesn’t have a long redemption period. You get a little time, but not much. If you don’t leave voluntarily, the new owner can start eviction proceedings. Which means sheriff’s deputies, court orders, and forced removal. It’s humiliating and traumatic.

The Emotional and Psychological Toll

Beyond the practical consequences, there’s the emotional devastation. The shame. The sense of failure. The disruption to your family. The loss of stability and security. The trauma of being forced from your home.

If you have kids, they have to leave their schools, their friends, their neighborhood. They have to process their parents’ stress and fear. They have to deal with the instability and uncertainty. This kind of upheaval affects children for years.

It Becomes Part of Your Story

For years afterward, applications will ask if you’ve ever had a foreclosure. Job applications, rental applications, and loan applications. You’ll have to check “yes” and explain. Over and over. Reliving it. Being judged for it.

But Here’s the Thing: None of This Has Happened Yet

You’re reading this, which means you’re still in pre-foreclosure. The house is still yours. You still have time. You can still prevent all of this.

Doing nothing guarantees the worst outcome. Doing something—even if it’s hard, even if it’s scary, even if it means letting go of the house—gives you a chance at a better outcome.

Your Real Options

Everyone tells you the same things: “Just pay what you owe.” “Call your lender and work it out.” “List it with a realtor.” Let’s talk about options that actually matter when you’re in crisis.

Option 1: The Hail Mary

If a relative dies and leaves you money, if you win the lottery, if a miracle happens and you suddenly have enough cash to bring your account current—do it. Problem solved immediately.

But you’ve probably already thought of this. If you had access to that kind of money, you wouldn’t be here. So let’s move on to realistic options.

Option 2: Loan Modification

You can call your lender—whoever services your loan, probably a big faceless corporation—and beg them to modify the terms. Lower the payment, extend the loan, defer what you owe, maybe even reduce the principal (rare).

Here’s the reality: This takes months. Endless paperwork. Hours on hold listening to muzak. Proving your financial hardship over and over. Sending the same documents multiple times because they keep “losing” them. Talking to different people who tell you different things.

And after all that, they might say no.

If you want to try this, try it. But do it while also exploring other options. Don’t put all your hope in loan modification while the foreclosure clock ticks down.

Option 3: Traditional Sale

List your house with a realtor. Get it market-ready—repairs, cleaning, staging. Professional photos. Open houses. Showings. Wait for offers. Negotiate. Inspections. More negotiations. Closing in 30-60 days if everything goes perfectly (it rarely does).

This works if:

- You have equity (the house is worth more than you owe)

- You have time (at least 60-90 days before the auction)

- You have money to invest in getting it ready

- You’re not too emotionally devastated to deal with showings and negotiations

- The Chattanooga market is good in your neighborhood

If those conditions don’t apply, this probably won’t work.

Option 4: Short Sale

If you owe more than your house is worth—and this happens, especially if you bought at a peak or took out too much equity—you can try a short sale.

This is where the bank agrees to accept less than the full mortgage balance. They take a loss, but it’s better for them than foreclosure.

But short sales are complicated:

- The bank has to approve everything

- It takes months, sometimes over a year

- You need a buyer willing to wait through the approval process

- Many buyers won’t wait

- There’s no guarantee the bank will approve

- You still take a credit hit, though less than foreclosure

Short sales can work. We’ve helped people do them. But they’re not quick or easy.

Option 5: Sell Fast for Cash

This is the option most people don’t know about or think is a scam until they learn how it actually works.

We buy houses directly. As-is. You don’t fix anything. You don’t clean anything. You don’t stage it or paint it or do any of the things you’d do for a traditional sale.

We come look at your house. We make you an offer based on the condition, the location, the market, and what you owe. If you accept, we handle everything—paperwork, title work, closing, dealing with the bank if it’s a short sale.

We can close in as little as 7-10 days if you need speed. Or we can take a few weeks if you need time to figure out where you’re moving.

No real estate commissions (usually 5-6% of the sale price). No closing costs out of your pocket. No dealing with buyer financing falling through or inspections killing deals.

You walk away without the foreclosure on your record. You get this chapter closed. You get to move forward with your life.

Is it going to be the maximum dollar amount you could get if you sold traditionally in perfect conditions after investing thousands in repairs and staging? Probably not. But it’s certain. It’s fast. It’s done.

What Happens When You Call Us

No pressure. No tricks. Here’s exactly what happens:

The Phone Call or Form

You reach out. We talk. You tell us your situation—what’s going on, what you owe, what condition the house is in, and what your timeline is. We listen. We ask questions to understand what you need.

This conversation is confidential. We’re not reporting you to anyone. We’re not judging you. We’re just gathering information.

The Visit

If you’re comfortable with it, we schedule a time to come see the house. We look at the property, the neighborhood, and the condition. We ask more questions. We measure some things. We take some photos for our records.

We’re not inspectors looking for every tiny flaw to beat you up on price. We’re investors who’ve seen everything. Your house doesn’t have to be perfect. It doesn’t even have to be good. We buy houses in all conditions.

The Offer

Usually, within 24-48 hours, we come back with an offer in writing. This is what we’re willing to pay for your house as-is, with us handling all the closing costs and complexities.

The offer is based on:

- What would your house sell for in its current condition

- What it would cost us to get it rent-ready or sell-ready

- What you owe on the mortgage

- Current market conditions in your specific Chattanooga neighborhood

- Our need to make enough profit to make the investment worthwhile

The offer might be lower than you hoped. It might be higher than you expected given the condition. Either way, it’s a real offer with no obligation.

You Decide

Take the offer. Show it to family. Show it to a lawyer if you want. Pray about it. Sleep on it. Think about your options.

If it works for you, wonderful. If it doesn’t, that’s okay too. No hard feelings. We’re not going to harass you or pressure you. This is your decision about your house and your life.

If You Accept: We Handle Everything

You sign some paperwork. We work with a title company to handle the closing. If it’s a short sale, we negotiate with your lender (we’ve done this many times). We handle all the details and complexities.

You show up to closing, sign the final documents, get your proceeds if there are any, hand over the keys, and walk away free.

No foreclosure on your record. No deficiency judgment hanging over you. This chapter is closed. Moving forward.

Real Stories from Real Chattanoogans

We’ve bought houses all over Hamilton County. Here are the situations people have been in:

“We got divorced. Neither of us could afford the house alone. We needed to sell fast before it went to foreclosure. You made it easy when everything else in our lives was complicated.”

“My dad died and left me his house in Highland Park. I live in Atlanta. I couldn’t afford to keep up two properties. You bought it as-is so I didn’t have to deal with repairs from three hours away.”

“The VW plant cut my hours. Then they laid me off. I found another job but it pays $15,000 less a year. I couldn’t make the mortgage anymore. Selling to you let me avoid foreclosure and start over.”

“Property taxes in St. Elmo tripled in five years. Our income didn’t triple. We were retired on fixed income. We had to sell. Your offer let us move somewhere we could actually afford.”

“Medical bills from my wife’s cancer treatment buried us financially. Even with insurance, we owed $80,000. We were trying to pay that and the mortgage and we couldn’t do both. You helped us get out from under the house so we could focus on her health.”

“We inherited a house that needed $50,000 in work. We didn’t have $50,000. You bought it as-is.”

“We were underwater—owed more than the house was worth. You worked with our lender on a short sale. Took four months but we got it done. No foreclosure, no deficiency judgment.”

“We just needed it to be over. The stress was killing our marriage, affecting our kids. Selling to you gave us peace.”

Different situations. Different neighborhoods. Different reasons. Same outcome: moving forward instead of staying stuck.

The Chattanooga You’re Leaving

Whether this ends with you staying in Chattanooga or moving somewhere else, let’s acknowledge what this city is.

Founded in 1839. Named after a Creek Indian word, though nobody agrees on which word or what it meant. Grew as a railroad hub—the junction where multiple lines met, making it strategically important during the Civil War. The Battle of Chattanooga in 1863 was one of the major turning points of the war. You can still see the battlefields—Lookout Mountain, Missionary Ridge, Chickamauga just over the Georgia line.

After the war, became an industrial city. Iron, steel, textiles, and manufacturing. By the mid-1900s, had the reputation as one of the most polluted cities in America. The air was so bad you couldn’t see Lookout Mountain from downtown some days.

Then came the environmental cleanup in the 1980s-90s. The city reinvented itself. Cleaned up the river and the air. Built the Tennessee Aquarium in 1992, which became a massive tourist draw. Developed the Riverwalk. Renovated the Walnut Street Bridge into a pedestrian bridge. Turned the old warehouses and industrial buildings into lofts, restaurants, and offices.

The gigabit internet launch in 2010 changed everything. EPB—the public electric utility—built a fiber optic network that provided the fastest residential internet in America. Tech companies took notice. Startups formed. The “Gig City” brand was born. Remote workers discovered they could live here.

Today, Chattanooga is a city of about 185,000 (over 560,000 in the metro area) that punches above its weight. It’s got:

- Some of the best outdoor recreation access in the Southeast (rock climbing, hiking, paddling, mountain biking)

- Lookout Mountain, Raccoon Mountain, and Signal Mountain surround the city

- The Tennessee River runs right through downtown

- The fastest internet in the hemisphere (10 gig now, actually)

- A revitalized downtown with restaurants, breweries, and music venues

- The Tennessee Aquarium, one of the best in the country

- Rock City, Ruby Falls, the Incline Railway—tourist attractions that have been here for generations

- The Walnut Street Bridge, the longest pedestrian bridge in the world when it opened

- A growing tech sector

- Volkswagen’s only US manufacturing plant

- A food scene that’s gotten genuinely good—Main Street Meats, St. John’s, Public House, Milk & Honey, dozens more

It’s a city that’s been on every “best places to live” list, every “where to move” article, every urban comeback story. It’s been in the New York Times, Outside Magazine, Forbes, everywhere.

It’s beautiful. The mountains around it are real, not just scenery. The river through it is wide and active. The outdoor culture is authentic—people actually hike and climb and paddle, not just post about it on Instagram (though they do that too).

But it’s also a city with real problems that don’t make it into the glossy articles. Poverty. Inequality. Racial segregation is still very much present. Neighborhoods that haven’t benefited from the renaissance. Schools that struggle. A housing crisis where prices are rising faster than incomes.

If you’re staying, you’re staying in a complicated place that’s beautiful and flawed, growing and struggling, celebrated and challenged.

If you’re leaving, you’re leaving behind mountains and a river and a community. That’s a real loss, even if leaving is the right decision.

This Doesn’t Define You

You need to hear this: Losing a house, or choosing to walk away from a house you can’t afford anymore, doesn’t define who you are as a person.

You are not your mortgage status. You are not your credit score. You are not the worst financial decision you ever made. You are not your bank account balance.

You’re a person who tried. Who worked. Who did your best in a system that’s increasingly rigged against regular people? Who faced circumstances—medical, economic, personal—that made it impossible to keep up.

This happens to good people. To responsible people. To people who did everything “right” and still got crushed by forces beyond their control.

The Chattanooga renaissance is real, but it hasn’t lifted everyone. The growing economy is real, but it hasn’t created enough good-paying jobs for everyone who needs one. The outdoor recreation culture is real, but you can’t pay a mortgage with mountain views.

You’re dealing with the gap between the story told about Chattanooga and the reality of living here on working-class wages. That gap isn’t your fault.

What matters now is what you do next. And the fact that you’re here, reading this, looking for solutions—that says something about you. It says you haven’t given up. It says you’re taking action. It says you’re brave enough to face a hard situation instead of hiding from it.

That matters.

Frequently Asked Questions

How fast is the foreclosure process in Tennessee?

From first missed payment to auction: usually 4-6 months. From official Notice of Sale: minimum 20 days. But if you’re reading this, the clock is already ticking. Every day matters.

Can I really sell while in pre-foreclosure?

Yes. The house is yours until the auction. You can sell right up until the gavel drops. We’ve helped people who had a week until their auction date. It’s better to have more time, but even with limited time, options exist.

What if I owe more than it’s worth?

We can help with short sales. We’ll negotiate with your lender. It takes longer but it’s doable. We’ve done it many times in Chattanooga neighborhoods where property values dropped or people bought at peaks.

Do I have to pay you or a realtor?

No. We pay all closing costs. There are no agent commissions. The offer we make is what you get (minus any mortgage payoff, obviously).

What condition does my house need to be in?

Any condition. Seriously. We’ve bought houses that needed new roofs, new HVAC, foundation work, and complete gut renovations. We’ve bought hoarder houses. We’ve bought fire-damaged houses. Condition doesn’t matter to us.

How quickly can you close?

As fast as 7-10 days if you need speed. Or a few weeks if you need time. Your timeline, not ours.

What if I need to stay for a bit after closing?

We can often work that out. A week or two, sometimes more. Let us know what you need.

Will this hurt my credit less than foreclosure?

Dramatically less. Late payments hurt. Foreclosure destroys. Selling avoids the foreclosure entirely.

What areas do you cover?

All of Hamilton County and the surrounding areas. Downtown Chattanooga, Northshore, St. Elmo, Highland Park, Red Bank, East Ridge, Hixson, Soddy-Daisy, Ooltewah, everywhere.

Take Your Next Step

You’ve read this far. That means you’re serious about finding a way forward.

You’re not alone in this. Hundreds of people in Chattanooga are dealing with the same thing right now. The difference is that most of them are suffering in silence, pretending everything’s fine, too ashamed to ask for help.

You’re here. You’re looking for solutions. That takes courage.

Titan Property Investors

Your trusted partner in real estate

Address

731 S. 7th St.

Heber Springs, AR 72543

Phone

Send us a message

We’d love to hear from you. Fill out the form below.